After the Amtrak Crash: Finding the Money to Fix Our Infrastructure

The Amtrak derailment in Philadelphia that left six people dead and dozens more injured has already prompted calls for increased infrastructure spending. "This one is a wake-up call," New York City Mayor Bill de Blasio said Wednesday on MSNBC’s Morning Joe. "We have got to get serious about investing in infrastructure."

There have been other wake-up calls before, and the dire need for infrastructure renewal isn’t news. Yet, as Politico’s Kathryn A. Wolfe reported, the deadly crash occurred just as a House panel was set to mark up a bill that would cut Amtrak’s funding for 2016 to $1.13 billion, or about $250 million less than the railroad service typically gets. (To be fair, it’s also not clear at this point what caused the horrific Amtrak derailment and whether infrastructure problems played a part or not — and the number of rail accidents each year has actually fallen significantly since 2006, according to Federal Railroad Administration data.)

Related: At Least 6 Die in Philadelphia Train Derailment, Scores Hurt

Even before the Amtrak tragedy, though, de Blasio and Oklahoma City Mayor Mick Cornett, a Republican, along with some two dozen other mayors were scheduled to travel to Washington, D.C. today to press Congress for a long-term renewal of the federal transportation authorization bill. The current funding law is set to expire May 31.

Pretty much everyone agrees that it’s well past time for the country to repair and rebuild its dangerously dated bridges, roads, railways, water mains and other critical infrastructure. The hold-up has always been over how to fund it.

Here’s one suggestion: The U.S. has spent some $110 billion on rebuilding Afghanistan, including billions that can’t be accounted for or that the inspector general has found have been wasted. That’s a drop in the bucket compared to the trillions in domestic infrastructure spending that some have called for. Still, clamping down on that waste in Afghanistan, and on other money being frittered away, might allow for some spending to be redirected to other necessary and more productive needs, like domestic infrastructure.

That’s not to suggest we must entirely abandon nation building abroad in order to rebuild this country. It’s just to point out that Congress should be able to find the money to address our national priorities, something it has miserably failed to do of late.

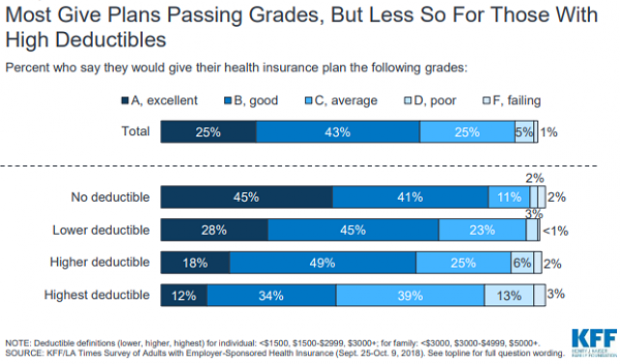

Chart of the Day: High Deductible Blues

The higher the deductible in your health insurance plan, the less happy you probably are with it. That’s according to a new report on employer-sponsored health insurance from the Kaiser Family Foundation and the Los Angeles Times.

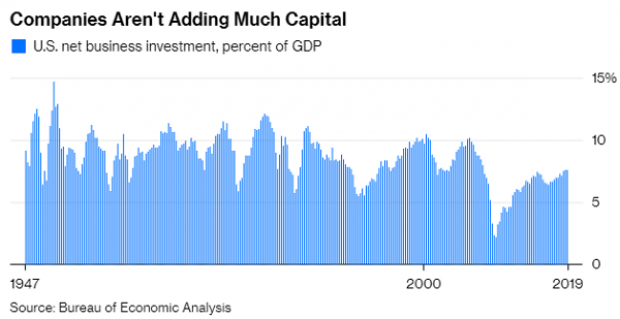

Chart of the Day: Tax Cuts and the Missing Capex Boom

Despite the Republican tax overhaul, businesses aren’t significantly increasing their capital expenditures. “The federal government will have to borrow an added $1 trillion through 2027 to pay for the corporate tax breaks,” says Bloomberg’s Mark Whitehouse. “So far, it’s hard to see what the country is getting in return.”

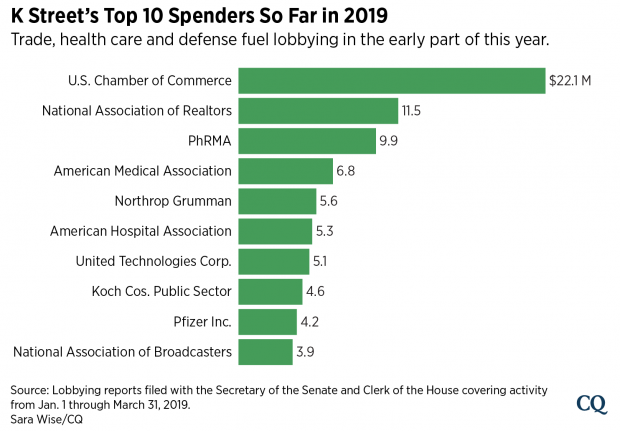

Chart of the Day: 2019’s Lobbying Leaders

Roll Call reports that trade, infrastructure and health care issues including prescription drug prices “dominated the lobbying agendas of some of the biggest spenders on K Street early this year.” Here’s Roll Call’s look at the top lobbying spenders so far this year:

Can You Fix Social Security? A New Tool Lets You Try

The Congressional Budget Office released an interactive tool Wednesday that shows how some widely discussed policy changes would affect the long-run financial health of the Social Security system.

“This interactive tool allows the user to explore seven policy options that could be used to improve the Social Security program’s finances and delay the trust funds’ exhaustion,” CBO said. “Four options would reduce benefits, and three options would increase payroll taxes. The tool allows for any combination of those options. It also lets the user change implementation dates and choose whether to show scheduled or payable benefits. … The tool also shows the impact of the options on different groups of people.”

Click here to view the interactive tool on the CBO website.

Why Prescription Drug Prices Keep Rising – and 3 Ways to Bring Them Down

Prescription drug prices have been rising at a blistering rate over the last few decades. Between 1980 and 2016, overall spending on prescription drugs rose from about $12 billion to roughly $330 billion, while its share of total health care spending doubled, from 5% to 10%.

Although lawmakers have shown renewed interest in addressing the problem, with pharmaceutical CEOs testifying before the Senate Finance Committee in February and pharmacy benefit managers (PBMS) scheduled to do so this week, no comprehensive plan to halt the relentless increase in prices has been proposed, let alone agreed upon.

Robin Feldman, a professor at the University of California Hastings College of Law, takes a look at the drug pricing system in a new book, “Drugs, Money and Secret Handshakes: The Unstoppable Growth of Prescription Drug Prices.” In a recent conversation with Bloomberg’s Joe Nocera, Feldman said that one of the key drivers of rising prices is the ongoing effort of pharmaceutical companies to maintain control of the market.

Fearing competition from lower-cost generics, drugmakers began over the last 10 or 15 years to focus on innovations “outside of the lab,” Feldman said. These innovations include paying PBMs to reduce competition from generics; creating complex systems of rebates to PBMs, hospitals and doctors to maintain high prices; and gaming the patent system to extend monopoly pricing power.

Feldman’s research on the dynamics of the drug market led her to formulate three general solutions for the problem of ever-rising prices:

1) Transparency: The current system thrives on secret deals between drug companies and middlemen. Transparency “lets competitors figure out how to compete and it lets regulators see where the bad behaviors occur,” Feldman says.

2) Patent limitations: Drugmakers have become experts at extending patents on existing drugs, often by making minor modifications in formulation, dosage or delivery. Feldman says that 78% of drugs getting new patents are actually old drugs gaining another round of protection, and thus another round of production and pricing exclusivity. A “one-and-done” patent system would eliminate this increasingly common strategy.

3) Simplification: Feldman says that “complexity breeds opportunity,” and warns that the U.S. “drug price system is so complex that the gaming opportunities are endless.” While “ruthless simplification” of regulatory rules and approval systems could help eliminate some of those opportunities, Feldman says that the U.S. doesn’t seem to be moving in this direction.

Read the full interview at Bloomberg News.