After the Amtrak Crash: Finding the Money to Fix Our Infrastructure

The Amtrak derailment in Philadelphia that left six people dead and dozens more injured has already prompted calls for increased infrastructure spending. "This one is a wake-up call," New York City Mayor Bill de Blasio said Wednesday on MSNBC’s Morning Joe. "We have got to get serious about investing in infrastructure."

There have been other wake-up calls before, and the dire need for infrastructure renewal isn’t news. Yet, as Politico’s Kathryn A. Wolfe reported, the deadly crash occurred just as a House panel was set to mark up a bill that would cut Amtrak’s funding for 2016 to $1.13 billion, or about $250 million less than the railroad service typically gets. (To be fair, it’s also not clear at this point what caused the horrific Amtrak derailment and whether infrastructure problems played a part or not — and the number of rail accidents each year has actually fallen significantly since 2006, according to Federal Railroad Administration data.)

Related: At Least 6 Die in Philadelphia Train Derailment, Scores Hurt

Even before the Amtrak tragedy, though, de Blasio and Oklahoma City Mayor Mick Cornett, a Republican, along with some two dozen other mayors were scheduled to travel to Washington, D.C. today to press Congress for a long-term renewal of the federal transportation authorization bill. The current funding law is set to expire May 31.

Pretty much everyone agrees that it’s well past time for the country to repair and rebuild its dangerously dated bridges, roads, railways, water mains and other critical infrastructure. The hold-up has always been over how to fund it.

Here’s one suggestion: The U.S. has spent some $110 billion on rebuilding Afghanistan, including billions that can’t be accounted for or that the inspector general has found have been wasted. That’s a drop in the bucket compared to the trillions in domestic infrastructure spending that some have called for. Still, clamping down on that waste in Afghanistan, and on other money being frittered away, might allow for some spending to be redirected to other necessary and more productive needs, like domestic infrastructure.

That’s not to suggest we must entirely abandon nation building abroad in order to rebuild this country. It’s just to point out that Congress should be able to find the money to address our national priorities, something it has miserably failed to do of late.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

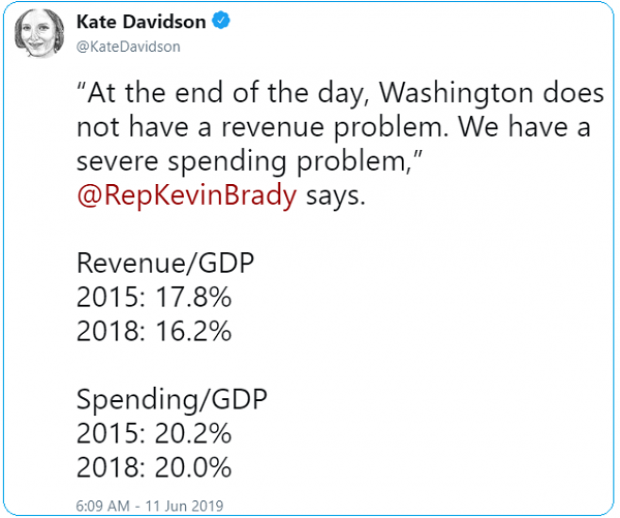

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

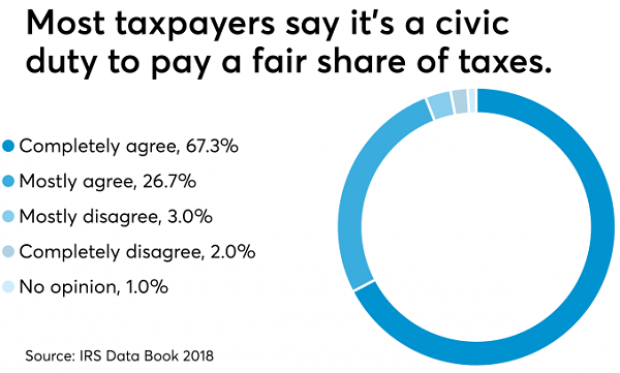

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.