15 Restaurants Offering Free Food for Moms on Mother’s Day

Your Mom was the one who taught you to head straight for the clearance racks. Show her how much you've learned by taking her out for some deliciously cheap eats before taking a free garden tour.

Related: 10 Worst States for Working Mothers

Mother's Day Freebies 2015

- Beef O'Brady's: Free Meal with purchase of equal or greater value up to $10

- Billy Sims BBQ: Free Single Meat Sandwich, Side and Drink

- Brick House Tavern & Tap: Free Brunch Entree with Entree Purchase (reservations required)

- Chuck E. Cheese's: Free Individual Thin & Crispy Pizza with $29.99 purchase of Large 1 Topping Pizza, 4 Drinks & 30 Tokens (requires printable coupon, exp. 6/1)

- Corner Bakery: Free 6 Pack Bottoms Up Bundts with Entree Purchase (printable coupon, exp 5/11)

- Fogo de Chao: Free Lunch or Dinner on Next Visit for Moms who dine on Mother's Day

- Hooters: Free Meal with Drink Purchase (up to $10.99)

- Hurricane Grill & Wings: Free Dessert with Entree Purchase

- McCormick & Schmick's: Free Chocolate-Covered Strawberry with your order

- National Public Gardens Day: Free admission 5/8, with many activities continued through Mother's Day

- Orange Leaf: Free 8-oz. Froyo

- PDQ: Free Combo Meal with purchase of a Kids/Combo Meal

- Shoney's: Free Slice of Strawberry Pie with your order

- Spaghetti Warehouse: Free Strawberry Lemonade and Surprise Gift

- Tijuana Flats: Free Entree (must show offer to redeem)

As always, local participation may vary, so call ahead to check - and then make reservations if you can.

This article originally appeared in The Brad's Deals Blog.

Read more from The Brad's Deals Blog:

6 Things You Should Never Waste Your Money

37 Things You Should Always Keep in Your Car

Is Vision Insurance Worth it For You

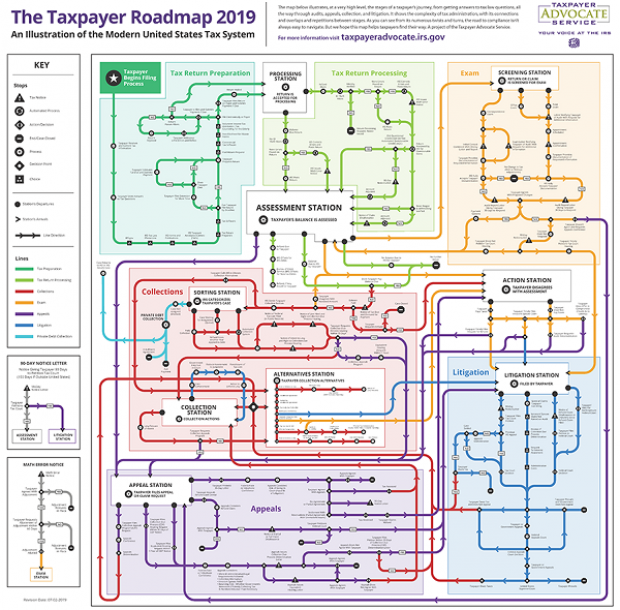

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

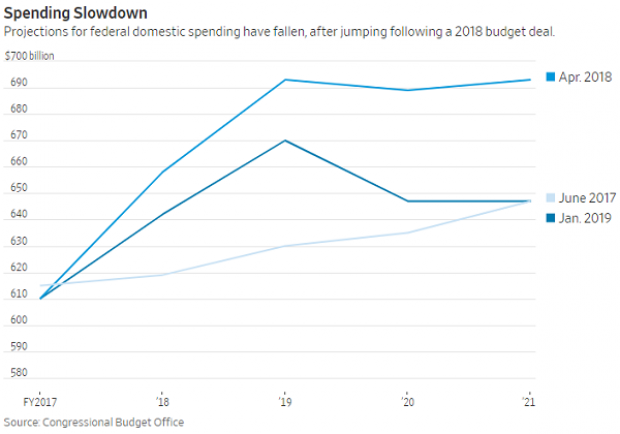

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

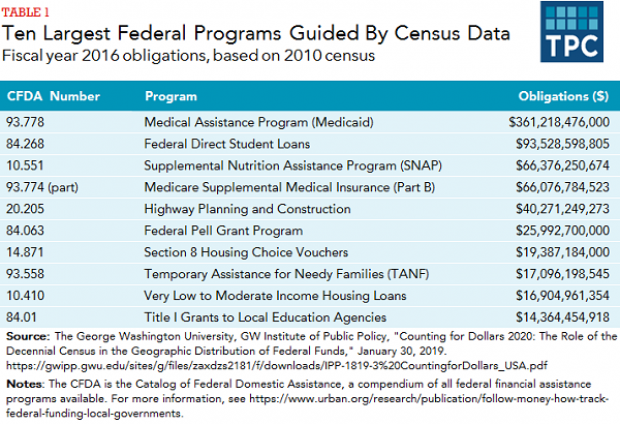

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

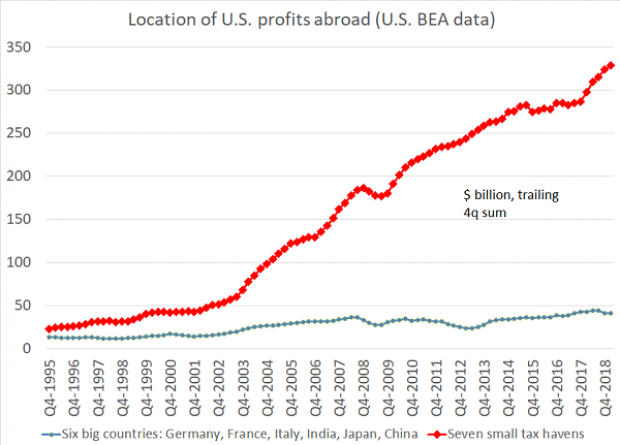

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”