The Woefully Distorted Federal Policies on Child Abuse

Here’s something just in from the world of grossly distorted government policy:

Every year, roughly 680,000 children are reported victims of neglect or abuse by their parents in this country – a tragic statistic reflective of troubling societal, psychological and economic problems. Even worse, 1,520 children died from maltreatment in 2013, nearly 80 percent of them at the hands of their own parents.

Related: Feds Blow $100 Billion Annually on Incorrect Payments

Federal and state authorities over the years have developed a large and costly system for reporting and investigating maltreatment, removing endangered children from their homes, and preventing and treating problems of parents and children.

But as a new study touted on Wednesday by the Brookings Institution concludes, the federal government provides states with far more money to support kids once they have been removed from their homes and placed in foster care than it provides for prevention and treatment programs to keep the kids out of foster homes in the first place.

And the disparity is startling.

Two of the largest grant programs in Title IV-B of the Social Security Act provide states with funding totaling around $650 million annually for “front end” services designed to prevent or treat parent and child problems that contribute to abuse and neglect. They address problems such as substance abuse, family violence and mental health issues.

Related: Time to Stop Social Safety Net Child Abuse

Yet another series of programs in Title IV-E of the Social Security law provides states with open-ended funding that totaled about $6.9 billion in 2014. Those funds pay almost exclusively for out-of-home care for children from poor families, along with the administrative and training expenses associated with foster care, adoption, and guardianship.

That’s a 10 to 1 disparity in funding for the two efforts – one to try to hold families together and the other to move children out of their homes and into foster care.

“Congress has the opportunity to change the funding formula under Title IV of the Social Security Act so that states have the flexibility to put money where it will be most effective at keeping at-risk children safe, ensuring that they have a permanent home, and promoting their well-being,” wrote Ron Haskins, Lawrence M. Berger and Janet Currie, the authors of the study.

In their policy brief, “Can States Improve Children’s Health by Preventing Abuse and Neglect,” Haskins, a Senior Fellow in Economic Studies at Brookings, Currie of Princeton University and Berger of the University of Wisconsin-Madison, write that revising the grant programs could improve the welfare of children who are at risk of abuse or neglect.

This is something else that lawmakers might consider later this year when they begin to focus on disability insurance and other programs within the Social Security law.

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

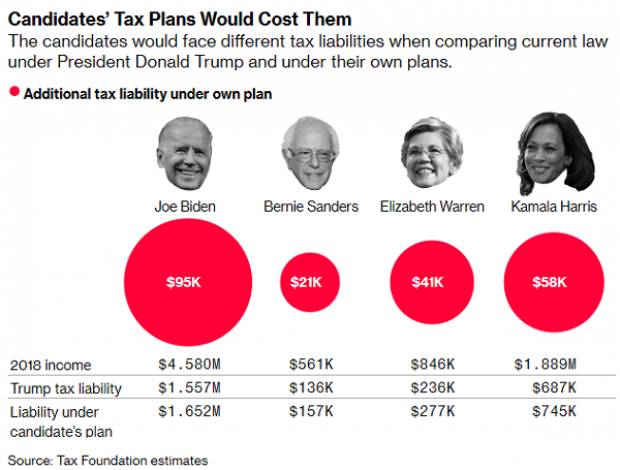

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.