The Woefully Distorted Federal Policies on Child Abuse

Here’s something just in from the world of grossly distorted government policy:

Every year, roughly 680,000 children are reported victims of neglect or abuse by their parents in this country – a tragic statistic reflective of troubling societal, psychological and economic problems. Even worse, 1,520 children died from maltreatment in 2013, nearly 80 percent of them at the hands of their own parents.

Related: Feds Blow $100 Billion Annually on Incorrect Payments

Federal and state authorities over the years have developed a large and costly system for reporting and investigating maltreatment, removing endangered children from their homes, and preventing and treating problems of parents and children.

But as a new study touted on Wednesday by the Brookings Institution concludes, the federal government provides states with far more money to support kids once they have been removed from their homes and placed in foster care than it provides for prevention and treatment programs to keep the kids out of foster homes in the first place.

And the disparity is startling.

Two of the largest grant programs in Title IV-B of the Social Security Act provide states with funding totaling around $650 million annually for “front end” services designed to prevent or treat parent and child problems that contribute to abuse and neglect. They address problems such as substance abuse, family violence and mental health issues.

Related: Time to Stop Social Safety Net Child Abuse

Yet another series of programs in Title IV-E of the Social Security law provides states with open-ended funding that totaled about $6.9 billion in 2014. Those funds pay almost exclusively for out-of-home care for children from poor families, along with the administrative and training expenses associated with foster care, adoption, and guardianship.

That’s a 10 to 1 disparity in funding for the two efforts – one to try to hold families together and the other to move children out of their homes and into foster care.

“Congress has the opportunity to change the funding formula under Title IV of the Social Security Act so that states have the flexibility to put money where it will be most effective at keeping at-risk children safe, ensuring that they have a permanent home, and promoting their well-being,” wrote Ron Haskins, Lawrence M. Berger and Janet Currie, the authors of the study.

In their policy brief, “Can States Improve Children’s Health by Preventing Abuse and Neglect,” Haskins, a Senior Fellow in Economic Studies at Brookings, Currie of Princeton University and Berger of the University of Wisconsin-Madison, write that revising the grant programs could improve the welfare of children who are at risk of abuse or neglect.

This is something else that lawmakers might consider later this year when they begin to focus on disability insurance and other programs within the Social Security law.

Wages Are Finally Going Up, Sort of

Average hourly earnings last month rose by 2.9 percent from a year earlier, the Labor Department said Friday — the fastest wage growth since the recession ended in 2009. The economy added 201,000 jobs in August, marking the 95th straight month of gains, while the unemployment rate held steady at 3.9 percent.

Analysts noted, though, that the welcome wage gains merely kept pace with a leading measure of inflation, meaning that pay increases are largely or entirely being canceled out by higher prices. “The last time unemployment was this low, during the dot-com boom, wage growth was significantly faster — well above 3.5 percent,” The Washington Post’s Heather Long wrote. The White House Council of Economic Advisers this week issued a report arguing that wage gains over the past year have been better than they appear in official statistics.

Cost of Trump’s Military Parade Rising Fast

It looks like President Trump’s military parade is going to cost a lot more than the initial estimate suggested – about $80 million more.

The Department of Defense pegged the cost of the parade at roughly $12 million back in July, but CNBC reported Thursday that Pentagon officials have increased their estimate to $92 million. The total consists of $50 million from the Defense Department and $42 million from other agencies, including the Department of Homeland Security.

The parade, which President Trump requested after attending a Bastille Day military parade in Paris last year, is scheduled for November 10 and will reportedly include aircraft, armored vehicles and soldiers in period uniforms. Abrams tanks, which weigh roughly 70 tons apiece, will also be included, CNBC said, despite concerns about heavy military equipment ripping up the streets of Washington. A Pentagon analysis apparently found that the armored vehicle’s treads would not cause any damage.

The parade is expected to begin at the Capitol, continue past the White House and end at the National Mall, according to earlier reports from NBC News.

Quote of the Day: Time to Raise Taxes?

“Tax revenue as a percentage of gross domestic product is expected to be 16.5 percent next year. The long-term average in a full-employment economy is 18.5 percent of GDP; if revenue were at that level for the coming decade, debt would be $3.2 trillion lower and the 10-year fiscal gap would be halved. Returning to past revenue levels, however, will be inadequate over time, because an aging population will increase Medicare and Social Security costs. This need not pose a problem: Revenue was roughly 19 percent of GDP in the late 1990s, and economic conditions were excellent.”

– Former U.S. Treasury Secretary Richard E. Rubin, writing in The Washington Post

Quote of the Day: When Tax Cuts Pay for Themselves

“You … often hear the claim that a lot of tax cuts will ‘pay for themselves,’ that they’ll cause so much additional economic activity that the revenue feedback from that activity will fully offset the direct revenue loss caused by the tax cut so that you end up making money for the federal government, or at least not losing any money. Now, of course that is theoretically possible and it would happen at extreme rates. I mean if a country had a 99 percent flat rate income tax and lowered it to 98 percent, I believe that they almost certainly would collect more revenue at the 98 percent rate than they did at the 99 percent rate. But the idea that this type of effect would occur at today’s tax levels just requires responses that are much bigger than statistical evidence would support and I think much bigger than common sense would indicate if you just ask people how they themselves would react to the tax cut.”

-- Alan Viard, tax policy expert at the American Enterprise Institute

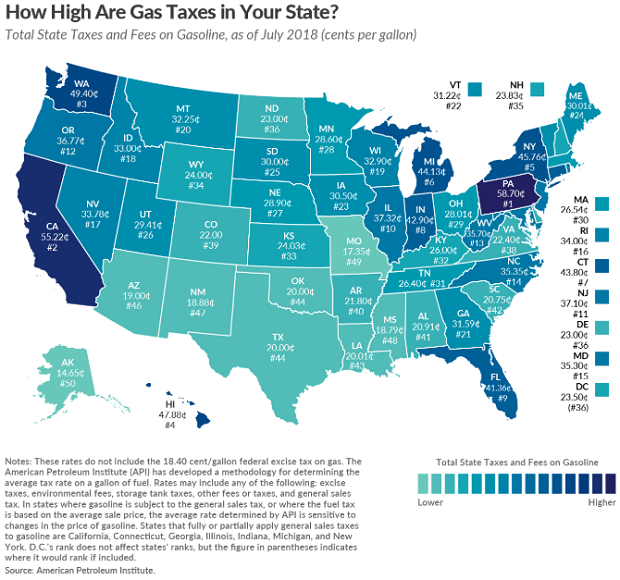

Map of the Day: Gas Taxes

It’s summertime and the driving is anything but easy if you want to get to your favorite beach or mountain cabin for a well-deserved break. As lawmakers consider a plan to raise federal fuel taxes by 15 cents a gallon, here’s a look at the current state-level taxes on gasoline, courtesy of the Tax Foundation: