Don’t Make This Surprisingly Common Credit Mistake

Checking your credit report regularly is a basic rule of personal finance. More than one in three Americans has failed to follow that rule — they’ve never looked at their report, according to a new study from Bankrate.com.

The report finds that 35 percent of all Americans have never reviewed their credit reports, and 14 percent check less than once a year. Senior citizens are the biggest slackers, with 44 percent saying they’ve never checked their report, followed by 41 percent of millennials.

Related: 5 Easy Ways to Ruin a Perfect Credit Score

Your credit report is the foundation of your credit score, a key number that landlords, employers and lenders use to measure financial responsibility. Having a good credit score is critical for financial success because it gets you access to lenders’ best rates and terms, which can save you thousands of dollars each year.

By law you are entitled to access your credit reports from each of the three major credit-reporting companies — Experian, TransUnion and Equifax — for free once every 12 months. You can do that at AnnualCreditReport.com.

The Bankrate survey found that about half of Americans have reviewed at least one of their credit reports within the past year, and a quarter of Americans review them more than once a year.

“Monitoring your credit goes well beyond scanning a three-digit number,” Bankrate credit card analyst Jeanine Skowronski said in a statement. “Americans need to thoroughly review their credit reports for errors or signs of fraud. They also need to understand what factors, like missed payments or high debt-to-credit ratios, are driving their credit score in order to improve it.”

If you don’t know what’s on your credit reports, now is a good time to find out.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

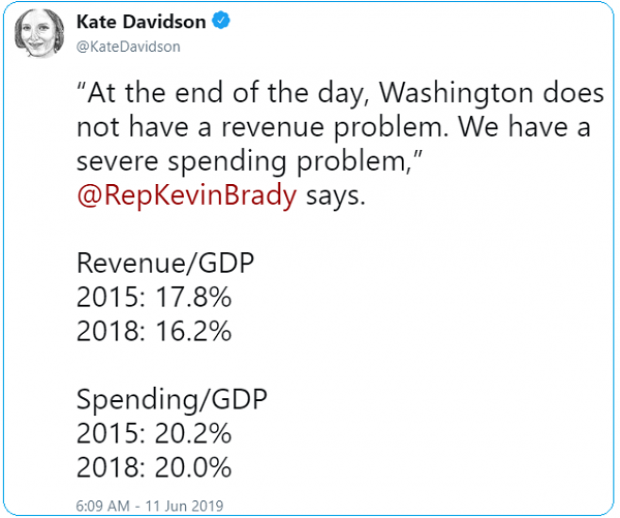

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

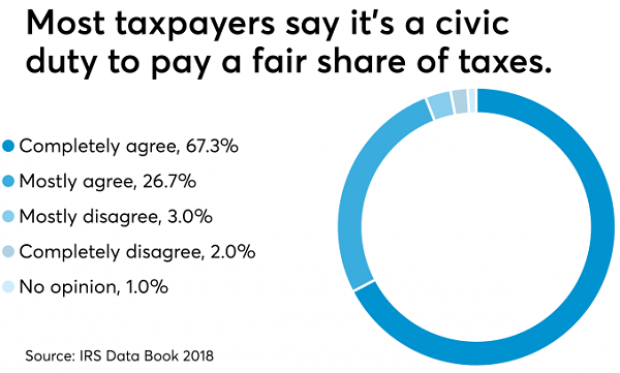

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.