These Students Are Making Even More Than They Expect After Graduation

College students who major in STEM fields generally know that they can make more money than their peers once they graduate, but they don’t know how much more.

Turns out, those students majoring in science, technology, engineering and math, actually have starting salaries that are higher than expected, according to a new report by the National Association of Colleges and Employers.

Engineering majors, for example, expect to earn $56,000, but actually receive 15.5 percent more than that, with starting salaries average nearly $65,000. Computer Science majors expect to make around $51,000, but receive 22 percent for an average starting salary of $62,000.

Chemistry majors have the largest gap between expectations and reality: They expect to earn an average of $39,000 but take home an average $58,000 in their first year, a 51 percent increase.

Related: The Closing of the Millennial Mind on Campus

The typical college graduate in 2014 received a starting salary of $48,000. Liberal arts and humanities majors had the lowest starting salary, with an average of just $39,000, according to NACE.

Not only do STEM majors enjoy higher salaries, but they can also expect more job security and better job prospects. All of the top 25 jobs recently compiled by U.S. News and World Report fell into either a science- or math-based discipline.

Still, not everyone has the interest or aptitude to excel in a STEM career. A third of those who begin their college career majoring in those fields end up transferring to a difference study area, according to a recent report by RTI International.

Coming Soon: Deductible Relief Day!

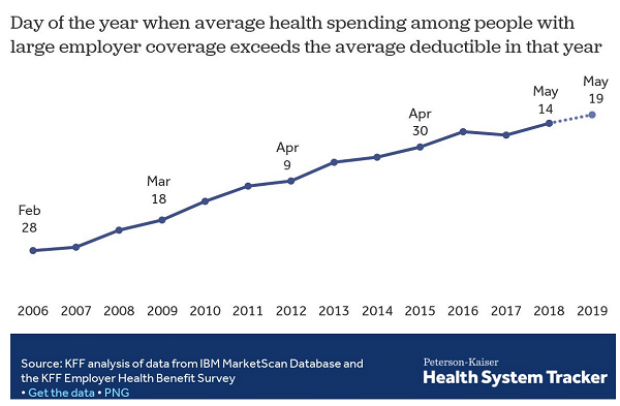

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

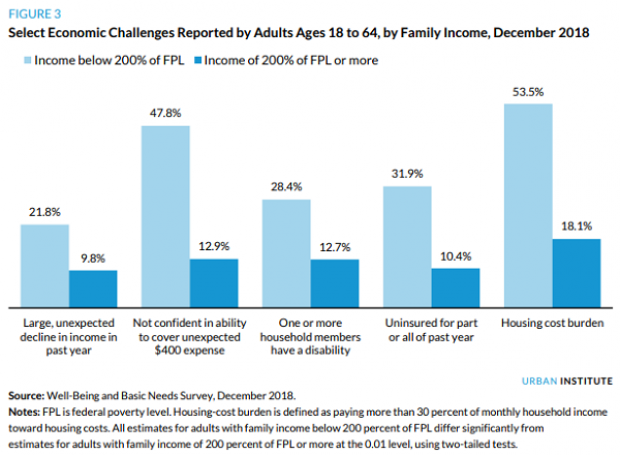

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

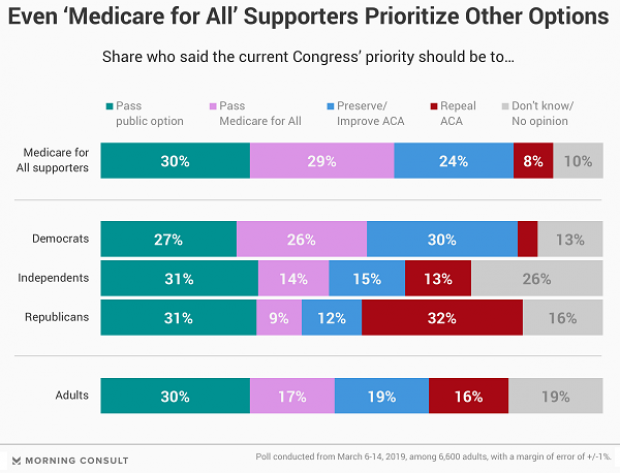

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

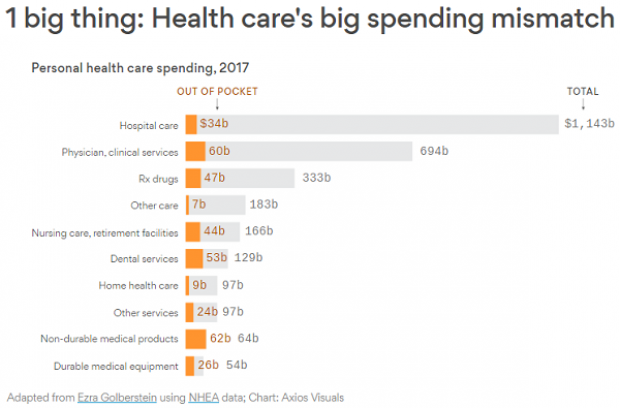

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.