In his latest salvo against steep cuts in his agency’s budget and manpower mandated by Congress in recent years, IRS Commissioner John A. Koskinen this week offered several telling statistics:

The IRS’s fiscal 2015 budget of $10.9 billion, while an increase over the previous year, was still $1.2 billion less than it was five years ago. During that time, the number of taxpayers has increased and the IRS’s permanent full-time workforce shrank by more than 3,000 employees.

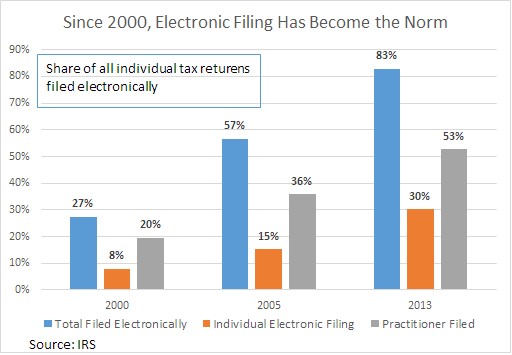

At the same time, the number of people filing electronically since 2,000 has increased exponentially. The non-partisan Tax Foundation recently wrote, “Complaints about the thousands of jobs lost at the IRS over the past decade ring as hollow as the loss of operators at the phone company. Electronic filing has reduced the need for armies of people to manually keypunch our paper tax returns into the IRS system and no doubt reduced the error rate dramatically…. By 2013, share of returns filed electronically had jumped to 83 percent [now 90 percent]. Remarkably, 53 percent of all returns today are prepared by practitioners, while 30 percent of taxpayers are preparing their own returns with the use of commercial software.”

Related: Just Try Getting Through to the IRS for Tax Help

Still, many of those lost workers were part of the Internal Revenue Service’s enforcement team -- auditors who review returns and conduct collection activities and special agents in the Criminal Investigation division who investigate refund fraud and other crimes.

During an appearance at a seminar Wednesday jointly sponsored by the Urban Institute and the Brookings Institution, Koskinen said the sharp decline in audit and collection-case closures this year alone will cost the government at least $2 billion of lost revenue collections.

“Essentially, the government is forgoing billions to achieve budget savings of a few hundred million dollars, since we estimate that every $1 invested in the IRS budget produces $4 in revenue,” Koskinen said.

The cumulative effect of the cuts in enforcement personnel since fiscal 2010 is an estimated $7 billion to $8 billion a year in lost revenue for the government. “As some have called it, this amounts to a tax cut for tax cheats,” the commissioner said.

Related: Budget Cuts and Mismanagement Boost IRS Tax Cheats

Republican lawmakers used budget cuts to punish the IRS in retaliation for scandalous behavior by some officials – including squandering millions of dollars on out of town conferences and targeting the tax-exempt status of Tea Party and conservative political groups during the 2012 election campaign.

Some lawmakers insisted the cuts were warranted to eliminate bureaucratic bloat and to force the agency to take steps to modernize its operations in order to do more with less. And the National Taxpayers Union argues that simply increasing the agency’s budget is not the answer.

But Koskinen insists that the cuts have been excessive at a time when the IRS has been required to take on more and more responsibility – including undertaking key aspects of the Affordable Care Act. The result, Koskinen says, has been a sharp decline in the quality of customer service at the height of the tax season and ill-considered reductions in the agency’s enforcement activities.

Koskinen said one of his biggest concerns is that without adequate funding, the IRS is struggling to update its technology and on-line services.

“After five years of budget cuts, and a hiring freeze that has lasted four years, people need to understand that the IRS is going to have to do less with less,” Koskinen said.

Top Reads from The Fiscal Times: