The federal government is failing to rein in the staggering amount of money it wastes each year doling out entitlement benefits and tax credits to the wrong people.

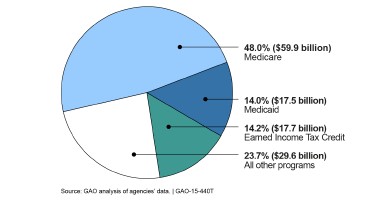

A new report from the Government Accountability Office reveals that the government handed out $124.7 billion in improper payments through Medicare, Medicaid and The Earned Income Tax Credit last year. That’s the highest amount recorded in recent history and represents a 17 percent increase from the previous year when improper payments totaled $105.8 billion.

Related: Medicare Doles Out $45B in Improper Payments

“This increase of almost $19 billion was primarily due to estimates for Medicare, Medicaid, and the Earned Income Tax Credit, which account for over 76 percent of the government-wide estimate,” the auditors said.

The massive increase comes despite the agencies’ attempts to crack down on improper payments. Several laws put in place over the last decade requires departments to document the amount of improper payments they make and report to Congress how much it costs the government. They’re also supposed to adopt agency-wide strategies to address the problem.

Separately, in 2010, Congress mandated that agency inspectors general keep track of whether their agencies were taking proper stops to reduce erroneous payments. Last year, the auditors reported to lawmakers that agencies were making progress, and in the first few years of the Obama administration, improper payments were down -- but that changed dramatically last year. Some attribute that to the increasing use of digital filing.

$74 Billion Food Stamp Program In Budget Crosshairs

Improper payments, as defined by the GAO, are payments that should not have been made or were made in the incorrect amount. While some of the erroneous payments come from fraud, others are the result of government errors.

Auditors said that Medicaid, which has a high rate of improper payments, is particularly vulnerably to erroneous payments made to people who aren’t eligible for Medicaid or for services that weren’t actually provided.

They added that since federal spending for Medicare and Medicaid is expected to significantly increase, it’s likely that improper payments among all three programs will also rise.

Related: Pentagon Didn’t Report $145 Million in Improper Payments

“With outlays for major programs, such as Medicare and Medicaid, expected to increase over the next few years, it is critical that actions are taken to reduce improper payments,” the auditors said.

Aside from the top three major programs paying out the most in improper payments, other government programs are also struggling with high error rates. For example, more than 11 percent of unemployment benefits paid out in 2014 were improper—costing $5.6 billion.

Top Reads From the Fiscal Times: