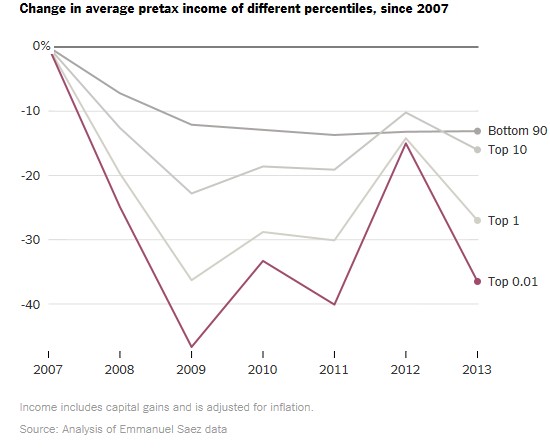

Have the rich become richer since the Great Recession? Ben Walsh, writing for The Huffington Post, argues that yes, they obviously have. Walsh’s conclusion is a rebuttal to calculations from the George Washington Institute of Public Policy’s Stephen Rose showing that income inequality is lower than it was at the onset of the Great Recession, which David Leonhardt covered in The Upshot, The New York Times’ economics data-journalism blog. Leonhardt emphasizes Rose’s finding that the richest Americans were hit the hardest by the financial crisis, and that their incomes still have not fully recovered.

The top one percent is obviously not hurting by anyone’s standards, but it remains the case that income inequality is lower and the rich are poorer than at the start of the recession. Despite his headline—“No, The Rich Have Not Gotten Poorer Since the Financial Crisis"—Walsh doesn’t actually challenge Rose’s conclusion.

Instead, he argues that the wealthy have gotten wealthier, which is a different question than that examined by Rose. Wealth and income are not the same thing; the former is the accumulation of annual accruals of the latter. But it’s not clear that the wealthy have gotten wealthier since the recession started either. Walsh cites wealth concentration estimates from economists Emmanuel Saez and Gabriel Zucman, showing that wealth concentration is higher today than 2007 or 2008. But wealth concentration can rise without the wealthy getting wealthier—they just have to see smaller wealth losses than everyone else.

In fact, the Saez-Zucman data actually show that the wealth of the top one percent declined by 3.5 percent from 2007 to 2012. Wealth levels did recover over this period for the top 0.1 percent, but only because wealth levels at the top jumped strikingly between 2011 and 2012. That is likely due to the tax policy changes that occurred at the end of that year, which raised the top tax rates for 2013 and caused many individuals to sell assets and realize capital gains in 2012 in order to avoid higher taxes. Saez admits that this affects the income tax data on which his wealth estimates are based. Since Saez and Zucman calculate their wealth estimates from the income reported on those returns, it would be surprising if the 2012 wealth estimates were unaffected by the tax changes.

Related: Why Americans Shrug Off Income Inequality

As an aside, it is also not clear that wealth concentration has risen, either over the long run or since the recession. The Saez-Zucman figures show that the share of wealth accruing to the top has risen fairly steadily from the late 1970s through 2012. But Walsh—and most progressives and economic journalists—have accepted the Saez-Zucman results as the last word on wealth inequality trends.

That is unwarranted, because different data sources yield different conclusions about the long-term trend in wealth inequality. A paper that Saez wrote earlier with Wojciech Kopczuk found that wealth inequality was not increasing as of the early 2000s. The different conclusions stem directly from the methods used to produce the different estimates. Richard Reeves of the Brookings Institution recently published a comprehensive summary of this divergence, and I wrote about it last June.

Saez and Zucman demonstrate in their paper that if they make the same key assumption as Saez-Kocpzuk (which is that mortality rates do not vary with wealth toward the top), they get results similar to the earlier paper. They then present evidence that this assumption is unwarranted. My read of the paper is that even if they are correct, what this exercise shows is that wealth concentration has risen because the longevity of the wealthiest adults has risen more than it has for others. Today, the wealthy live longer relative to others, which gives them more time for their wealth to compound. That’s a different story than the assumed one in which at any age, the top is accruing more and more. But it’s premature at any rate to accept that the assumptions in Saez-Zucman are less problematic than those in Saez-Kopczuk, a point conveyed well by a recent review by Kopczuk, who is not ready to throw overboard the earlier results showing not rise in wealth concentration.

Related: The Mobility Myth and Other Income Inequality Surprises

Walsh also argues that regarding income concentration, “Measuring income changes from 2007 does not help you understand the long-term trend in income inequality… And the long-term trend of income inequality really is exactly what you probably think it is: increasing.”

That’s exactly right—as Rose and Leonhardt say themselves. Leonhardt’s article features a large chart with the title, “Inequality, Higher Than it Was,” showing the long-term trend in income inequality. He unambiguously writes, “It’s even possible that inequality will soon surpass its 2007 peak, because the affluent often fare better than any other group in the second half of an economic expansion… Whatever happens in the next few years, top incomes will almost certainly remain vastly higher than they were in previous decades, while incomes for the middle class and poor will remain only marginally higher.” Rose also writes in his companion column to Leonhardt’s that, “While the share of all income held by the top 1 percent in 2011 was the same as the one that existed in 1998, it still is much higher than the 7 percent share of income that the 1 percent had in 1979.”

The point is that precision matters in making empirical statements. Scholars like Rose are careful to be clear about what they are saying and what they are not. Whether income inequality is rising is one question, whether wealth inequality is rising is another, whether incomes have fallen at the top is a third, and whether wealth has fallen at the top is a fourth. No one is arguing that income inequality has not grown, but people are arguing about whether wealth inequality has. Incomes at the top had clearly not recovered by 2013 while the wealth of the top probably had not by 2012. Strong claims beyond these conclusions are unwarranted.

Scott Winship writes for e-21, Economic Policies for the 21st Century, where this piece was originally published. He is also the Walter B. Wriston Fellow at the Manhattan Institute for Policy Research.

Top Reads from The Fiscal Times: