Positive momentum is building in the markets on two critical fronts: crude oil and the question of further interest rates hikes from the Federal Reserve this year. U.S. equities posted their second consecutive intra-day rebound on Thursday, and the Dow Jones Industrial Average gained 1.3% to break over its 50-day moving average for the first time since December.

Sure, there are still multiple concerns weighing on investors, from the risk of a hard landing in China to the implications of negative interest rates in Europe and Japan.

Above all else, though, oil and interest rates matter most. And investors are finally getting some good news, opening up the potential for a multi-month stock uptrend for the first time since October.

Related: Here’s What Could Save Stocks from the Abyss

Oil prices moved higher on Thursday on news that a number of major producers would hold a meeting in March to discuss a proposed supply freeze. Venezuelan oil minister Eulogio Del Pino said his country will attend, along with Saudi Arabia, Russia and Qatar.

This is critical as the supply situation at the Cushing transfer hub worsens, with Genscape data showing stockpiles rose to more than 67 million barrels last week; the storage facility has a capacity of 73 million barrels.

Amid much back and forth between OPEC and non-OPEC producers over the last few weeks as they jockey for negotiating position -- whipsawing energy prices with every move -- cooler heads seem to be prevailing. Russia's energy minister said Iran might need special treatment since it is ramping up to pre-sanctions levels, while Qatar's energy minister and former OPEC president said a freeze agreement could send oil prices back above the $50-a-barrel level within a year.

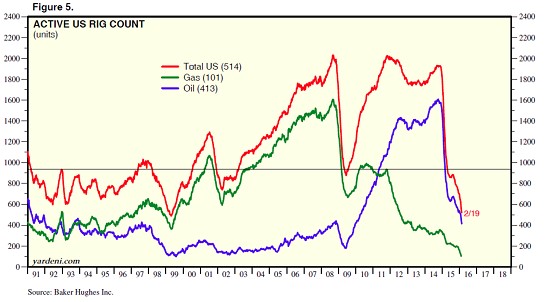

The U.S. energy industry is feeling the pressure as well. Halliburton announced another job cut totaling 8 percent of its workforce. Asset sales are the newest obsession in the shale patch, begging the question of who wants to buy these assets in this market? Yardeni Research indicates that U.S. drilling rig counts have plunged to Clinton-era lows not seen since 1999.

U.S. oil production remains above nine million barrels per day, down from a peak near 9.6 million barrels, but is poised for a rapid collapse as the pain threshold is crossed and defaults and bankruptcies loom. Without working capital to meet payroll, derricks will fall quiet.

Related: $17.5 Billion Hedge Fund Bigwig Says This Is a ‘Wall Street Recession’

At the Federal Reserve, St. Louis Fed president James Bullard, who has a record of reversing stock market dives with well-timed opining, said the case for raising rates was losing urgency and that the Fed and markets are not on the same page when it comes to the outlook on rates.

Fed vice-chair Stanley Fischer said Tuesday night that it was too early to judge the ramifications of recent market volatility. In a hint on the likely path from here, he added that a modest overshoot of the Fed's employment goal -- that is, pushing the unemployment rate below their long-term estimate -- would help inflation return to the Fed’s 2 percent target more quickly.

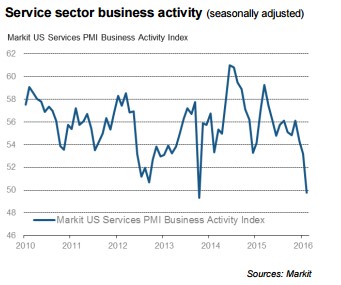

The Fed is still officially expecting four quarter-point rate hikes this year, but the futures market doesn't expect any further action until 2017. That gap should be closed when the Fed next meets on March 15 and 16 and updates its Summary of Economic Projections, or "dot plot," to reflect recent weakness, including the drop in U.S. services sector activity as shown below.

A continuation of these two trends -- a rate hike pause and an oil price recovery -- should continue to sustain what looks like the best uptrend initiation in stocks since October. Investors would do well to keep an eye on precious metals and materials stocks, which have been leading the market higher out of the January-February lows.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters. A two-week and four-week free trial offer has been extended to Fiscal Times readers.