Stocks are getting slammed again on Friday after the Dow Jones Industrial Average fell 2.1 percent on Thursday to close below the 17,000 level for the first time since October. The S&P 500 dipped below 2,000 and sliced below its 200-day moving average, putting its post-2011 uptrend at risk. Hints of panic are in the air as well, as the CBOE Volatility Index (VIX) surged 25 percent yesterday and another 23 percent today to return to levels not seen since October.

Many catalysts were fingered for blame, especially a weak early reading on factory activity in China — further evidence that the Chinese economy is slowing down. There are also worries about corporate earnings amid the ongoing slide in oil prices. And company-specific news is weighing as well, with Disney (DIS) down hard on cord-cutting concerns.

Related: The Stock Market’s Fed Fever Is Only Going to Get Worse

But underneath it all lies the ongoing fear over the approaching potential rate hike from the Federal Reserve on Sept. 17. We're in the midst of "hike havoc" — not unlike the "taper tantrum" of mid-2013, when former Fed Chairman Ben Bernanke publicly broached the beginning of the end of the QE3 bond purchase stimulus program. Traders seem concerned the Fed could be mulling a rate hike despite a lack of progress on pushing inflation back to its 2 percent target.

The reason? This statement from the meeting minutes of the Federal Open Market Committee: "Many participants indicated that their outlook for sustained economic growth and further improvement in labor markets was key in supporting their expectation that inflation would move up to the Committee's 2 percent objective."

Translation: Even if inflation remains soft, the Fed could pull the trigger on rate liftoff based on stable GDP growth and steady job gains.

Related: Soft Economic Data Could Provide a Hard Lesson for the Market

The big question is: Will the Fed ignore building financial market turmoil or be pressured into waiting? The Fed seems to be tilting towards an earlier rate liftoff with a pause afterward (the "one and done" scenario for 2015). Fed Chair Janet Yellen has tried, unsuccessfully, to play down the importance of liftoff timing and has said that wage growth and inflation aren't a precondition for the initial rate hike.

But the last time the Fed faced a cliffhanger decision, it blinked. Bernanke delivered a surprise "no taper" decision at the September 2013 policy meeting, postponing the taper until December, just three months before Yellen began her term.

As a result, I believe the stock market turmoil will continue until the Federal Reserve's September rate hike is taken off the table. If this happens, as I discussed this week, it could very well take a 2015 rate hike off the table completely since there are problems with an October or December hike.

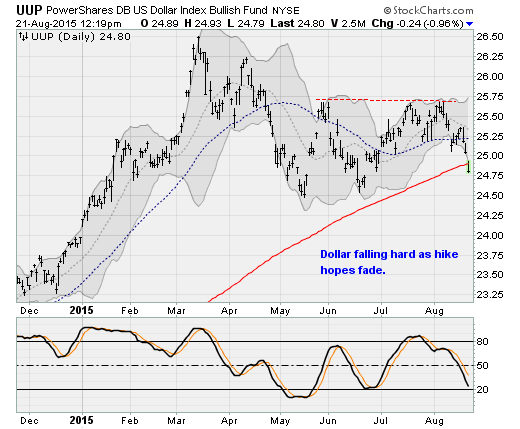

For their part, currency traders are already pricing in a backtracking by Yellen. The U.S. dollar, as shown above, tumbled out of a five-month trading range on Thursday as the foreign exchange market believes that the hopes of monetary policy normalization are fading.

Related: The Clearest Sign That the Job Market Hasn’t Really Recovered

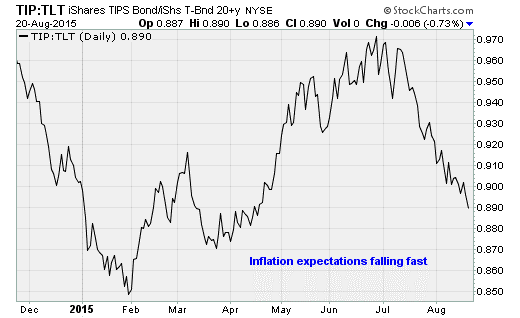

It's the same story in the bond market. The chart below shows inflation expectations as derived from trading in U.S. Treasury bonds vs. trading in Treasury Inflation-Protected Securities. When the line rises, it's a sign the bond market is pricing in higher inflation expectations. As clearly shown, inflation expectations have been dropping rapidly from early July.

The Fed, it seems, missed its moment to act.

The winners in all this have been the precious metals — including gold, which I recently recommended. The Gold Trust SPDR (GLD) on Thursday gained 1.7 percent to push over its 50-day moving average for the first time since June, pushing up the shares of mining companies like Kinross Gold (KGC) and Barrick Gold (ABX).

Disclosure: Anthony has recommended GLD calls, and KGC and ABX long positions, to his clients.