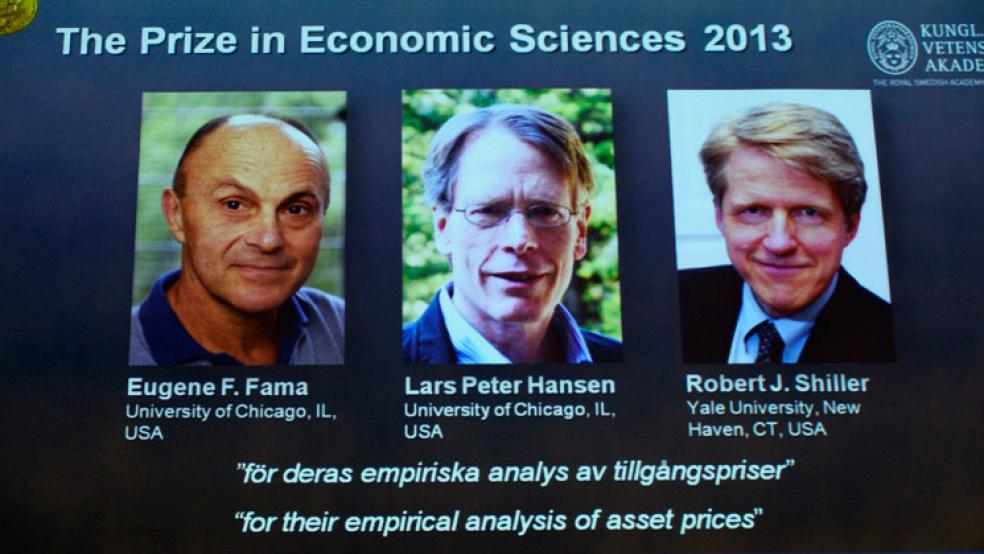

The Nobel Prize in Economics was awarded to Eugene Fama, Lars Hansen, and Robert Shiller mainly "for their empirical analysis of asset prices.” But the differences between Fama and Shiller on the theoretical underpinnings of their empirical work, particularly the theory of efficient markets and the assumption of rational expectations, has been a big part of the discussion of the prize.

Fama is a staunch defender of efficient markets and rationality, while Shiller argues, “The theory makes little sense, except in fairly trivial ways.” Shiller emphasizes “the enormous role played in markets by human error, as documented in a now-established literature called behavioral finance.” Shiller also says, with regard to rational expectations, that “Professor Fama avoids theories that describe … irrational behavior, and I think he’s wrong about that.”

Is Shiller correct? Should economists drop the assumption of rational expectations, at least in some instances?

Prior to the rational expectations revolution a few decades ago, economists generally assumed expectations were formed adaptively. Under adaptive expectations, expectations are based upon past trends. If a variable has been trending upward or downward in the recent past, then people will project that trend into the future. The problem with this model of expectations comes when there is information available that indicates the trend will be changing.

Who would assume a trend will continue when there is good information saying otherwise?

A second problem is that modeling expectations in this way can lead to false conclusions about the effectiveness of monetary and fiscal policy. If a model does not take account of how people will react to an announced change in policy, if we assume, for example, that workers will base their wage demands on past inflation rates even though the Fed has announced it will pursue a higher target in the future, the predictions of the model will go awry.

Rational expectations attempts to avoid this mistake by assuming people optimally incorporate all available information into their expectations. Information about past trends, likely shocks or future policy changes, and how the shocks or policy changes will impact macroeconomic variables of interest is used to produce the best possible expectations.

The rationality assumption is reasonable in some cases. For example, even young children have rational expectations in the sense that economists use the term. Think, for example, of a game where a parent is tickling a child and following a fixed rule. Tickle the armpit, tickle the knee, tickle the armpit, tickle the knee, and so on in a repeating pattern.

If the child is following the simplest type of adaptive expectations in trying to cover up and avoid being tickled, i.e. expect whatever happened last period, he or she will always be one step behind and will never block a tickle. But if the child understands the rule the parent is following and also fully understands the nature of the game, it is easy to rationally anticipate where the next tickle attempt will be and take evasive action.

The assumption of rational expectations is still present in most models today. But is it proper to assume that, like the child playing the tickle game, people fully understand the policy rules that monetary and fiscal policymakers are using to stimulate or slow down the economy? And do they also understand the nature of the economy, i.e. how those policy changes will impact macroeconomic variables, so they can rationally anticipate macroeconomic outcomes?

For monetary policy, where the Fed goes out of its way to make its policy rule known, and in financial markets where the participants study the markets as part of their jobs and there are considerable amounts of money on the line, perhaps those conditions are approximated. But does anyone understand what policy rule can be used to anticipate fiscal policy actions (who expected Congress to cut spending in a recession?), and does the typical household sufficiently understand how policy shocks affect the economy?

I think it’s a stretch to assume that people have this knowledge, but there are two responses to the objection that the economy is too complex for individuals to understand in the sense that rational expectations requires. The first is an “as if” argument. Think about a child who catches a ball thrown from some distance away.

Mathematically, catching the ball requires the child to solve a differential equation almost instantly, an impossible task. But our brains have developed a way to solve this problems that makes us act “as if’ we are finding the full mathematical solution. Perhaps our brains use similarly mysterious techniques that make us act “as if” we fully understand how the economy operates.

The other argument is that although individuals may not get things exactly correct, markets aggregate information efficiently, e.g. individual errors average out at the market level. Thus, according to this view markets overcome the errors made by individuals and it’s proper to model markets as if expectations are rational.

Is either argument correct? Our brains may be hard-wired to track and catch an object in flight, the solution to that problem comes down to a very simple rule the brain can employ, but do such simplifications and rules of thumb work in such a complex economy, one that professional economists do not fully understand? I’m skeptical that they do, and I’m also skeptical that markets can somehow magically compensate for the large and varied misunderstandings that typical households have about the economy.

Rational expectations are important for two reasons. First, they serve as a “perfect case” benchmark. In order to understand departures from rationality such as those embraced by Shiller, we need to know how the economy will function if agents fully understand everything about the economy, and can process the information optimally.

Assuming rational expectations is like assuming a perfect vacuum in physics – it provides a baseline that can be augmented with real-world features. Second, there are cases – simple games and financial markets for example – where the assumption of rational expectations may be approximately satisfied. But it’s a mistake, I think, to assume that rational expectations apply in all other settings or to the economy as a whole.

Economists need to know a lot more about when rational expectations apply and when they do not, and we need to amend our models appropriately. Behavioral economics is pushing us in this direction and providing some of the answers, but we have a long way to go before we’ll understand where and when the assumption of rational expectations is warranted.