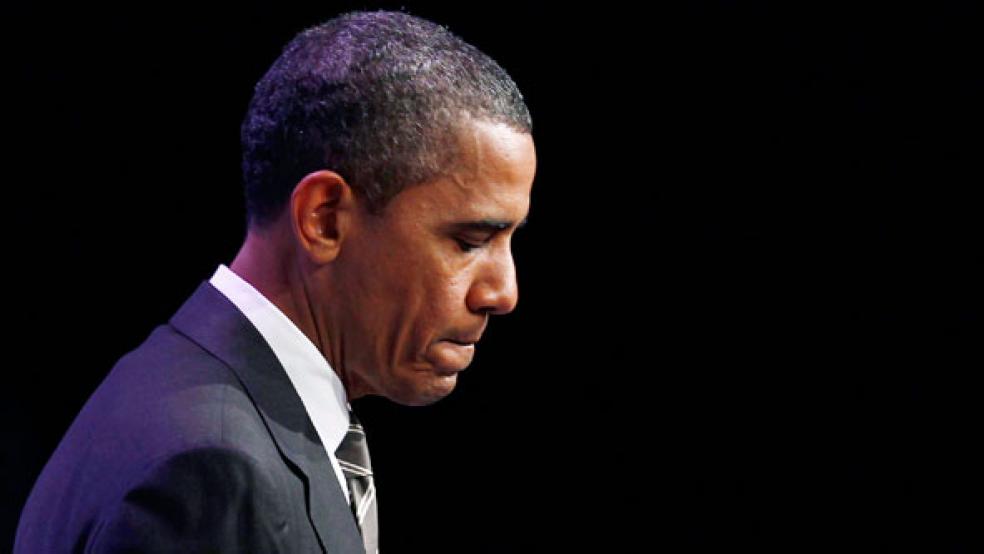

With the coming budgetary showdown, President Obama appears to have fully migrated into lame duck status.

The president still has more than three years in the Oval Office, but his influence has definitely been on the wane. After facing stiff congressional resistance on his request to bomb Syria, Obama got upstaged last week by Russian President Vladimir Putin, who successfully floated a deal to have the Middle Eastern country surrender its chemical weapons.

Then on Sunday, Obama’s alleged favorite to succeed Ben Bernanke as Federal Reserve chairman withdrew from the running. Economist Larry Summers—a past Obama adviser, Harvard University president, and Treasury secretary—could not muster enough support from four key Democrats on the Senate Banking Committee.

It’s a bad sign for the upcoming negotiations with Congress on the 2014 budget and on raising the government’s $16.7 trillion borrowing authority to prevent a possible default. This pressure began building steadily in April.

“Historically, both [the Fed and military action] have been treated as the president’s prerogative – Congress might have grumbled, but it wouldn’t have defied him,” said Patrick Chovanec, chief strategist at Silvercrest Asset Management, in a client note. “The perception that Obama is politically weak – at home and abroad – could play a role in shaping the upcoming battle over the fiscal budget.”

Obama spoke to the nation on Monday about how the economy has mended since the bankruptcy five years ago of the Wall Street power player Lehman Brothers, which triggered the biggest economic meltdown since the Great Depression. (Those remarks—initially scheduled for 11:40 am—were delayed after a fatal shooting at the U.S Navy Yard in Washington.)

RELATED: 5 YEARS AFTER CRISIS, BLAME WASHINGTON OR WALL STREET?

But the recovery and regulatory overhaul that Obama will be touting are part of his problem. The gross domestic product grew at a plodding 2.2 percent in 2012. The unemployment rate fell from a peak of 10 percent to 7.3 percent, but that is still much higher than the historic average.

The president passed a $787 billion stimulus bill in 2009 to spur the recovery, in addition to later passing a temporary reduction in payroll taxes and extending unemployment benefits. The Fed slashed its key interest rate to near zero, then in three separate instances starting sweeping up Treasury notes and mortgage-backed securities to hold down rates.

Polling by the Pew Research Center found that most Americans believed that these actions aided banks and large corporations, while 71 percent say it did little to nothing for the middle class.

All of those interventions—and the lukewarm recovery that followed—contributed to a decline in public trust in the federal government. Obama may blame his difficulties on House Republicans, but as president he appears to be bearing the brunt of this cynicism, as his message is that government policies can improve lives.

Just 42 percent of Americans expressed confidence in Washington’s ability to handle domestic problems, the lowest reading in 40 years, according to a survey released Friday by the Gallup Organization.