Insulin prices have sparked outrage in recent months, with Congress holding hearings on the issue and launching bipartisan investigations into why the cost of the hormone used to treat diabetes — discovered nearly a century ago — has soared over the past two decades.

The House Energy and Commerce oversight subcommittee held a hearing on insulin prices this week and will hold another next week. Executives from the three companies that dominate the global insulin market — Eli Lilly, Novo Nordisk and Sanofi — are expected to testify at the upcoming hearing.

“We want to know why the cost of this life-saving drug has skyrocketed in recent years, and why they’re not offering more lower-cost alternatives to patients,” Rep. Diana DeGette (D-CO), who chairs the subcommittee, said this week.

Amid the increased pressure from lawmakers, Eli Lilly last month said it would begin selling a generic version of its insulin Humalog at half the retail price. And health insurer Cigna’s Express Scripts pharmacy benefit manager announced this week that it would cap the out-of-pocket copay for patients on insulin at $25 a month. "What we're hoping is that we're going to see more diabetics taking more insulin, [fewer] complications for those patients, and hopefully lower health care costs," Steve Miller, Cigna's chief clinical officer, told NPR.

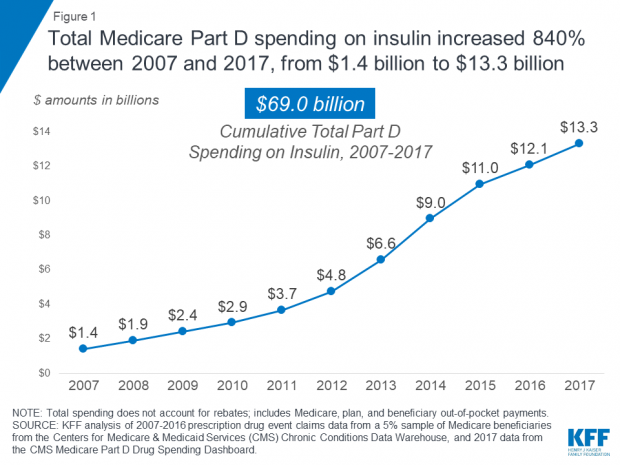

Why it matters: The human toll of rising insulin prices — and diabetics rationing the drug as a result, sometimes with deadly consequences — makes this a crisis that desperately needs to be addressed. But there’s a fiscal element to the story, too: Total Medicare Part D spending on insulin grew from $1.4 billion in 2007 to $13.3 billion in 2017, an 840% increase, according to a report published this week by the Kaiser Family Foundation.