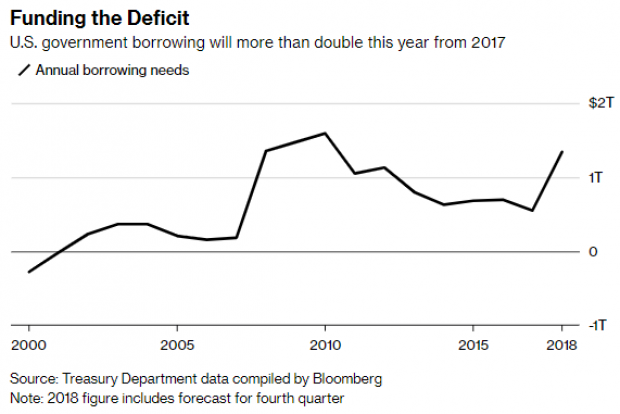

The U.S. Treasury said Monday it expects to issue about $425 billion in debt this quarter, raising its 2018 borrowing to more than $1.3 trillion, a 145 percent increase from the $546 billion issued in 2017.

The 2018 total would be the largest annual total since 2010, when the Treasury issued $1.586 trillion in debt.

“The debt binge is extraordinary by historical standards,” says The Washington Post’s Christopher Ingraham. “In only two years has the government borrowed more money, in nominal terms — 2009 and 2010, when the country was grappling with the effects of the Great Recession.”

Bloomberg’s Randy Woods summed up the current fiscal situation this way: “The Treasury is boosting sales of bills, notes and bonds in part to help finance a budget gap that’s widening after President Donald Trump signed $1.5 trillion in tax cuts late last year and the Republican-controlled Congress approved a roughly $300 billion spending increase. Meanwhile, the Federal Reserve is shrinking its balance sheet and choosing not to replace its holdings of some Treasuries as they mature, and an aging population is boosting costs of federal programs such as Medicare.”

The Congressional Budget Office projects a $973 billion deficit for the current fiscal year, rising to more than $1 trillion in fiscal 2020.