The Congressional Budget Office won’t release new budget projections that include the effects of the President Trump’s tax overhaul until April, but on Friday the deficit hawks at the Committee for a Responsible Federal Budget produced their own projections based on the CBO’s methods. The analysis shows annual deficits surpassing $1 trillion starting in 2019, three years earlier than previously expected, and the national debt growing larger than the economy in the next decade. In all, the tax cuts and spending deals are projected to increase the debt by $2.4 trillion over 10 years.

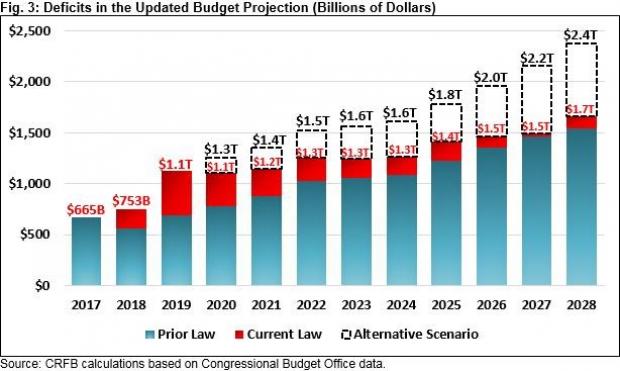

The analysis lays out two different possible paths, one based on a current law, in which some personal tax cuts are phased out after 2025, and another based on the assumption that the personal tax cuts will be extended and that recent spending increases defined in the Bipartisan Budget Act continue. The second scenario, which CRFB refers to as “more realistic policy assumptions” and many policy experts see as likely, produces the most dramatic increases in debt and deficits.

Here’s how the two paths play out in the CRFB model with respect to deficits, along with the prior law projections – note that the deficit hits $2 trillion in 2026 and $2.4 trillion in 2028 under the “realistic” assumptions:

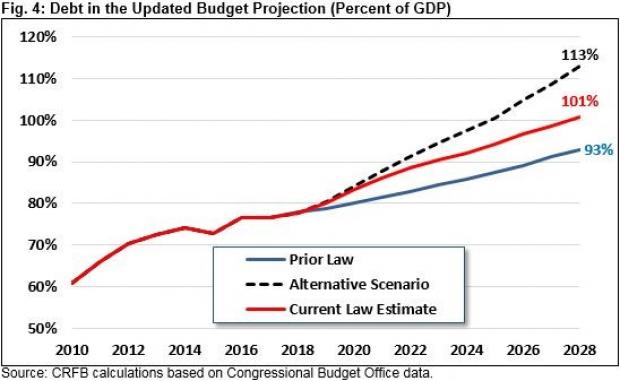

The national debt is projected to grow significantly as a result of the large and growing deficits. Before the tax bill became law, CBO projected the debt to hit 93 percent of GDP by 2028. Under the “realistic” scenario, debt will be 113 percent of GDP by that date. And even if Congress does allow the personal tax cuts to expire, the debt will still slightly exceed GDP in 10 years.

The CRFB report also notes that while the tax cuts and the spending deal may have accelerated the growth in the debt and deficit, the underlying dynamics are driven by rising costs in “Social Security, health care, and interest on the debt.”

Maya MacGuineas, president of the CRFB, highlighted the unusual nature of the current fiscal situation: “This is really perhaps the most fiscally irresponsible period of recent history. There is no economic reason to borrow. There’s not fiscal justification for borrowing. The only reason is basically lawmakers want to have a lot of giveaways in the form of taxes and spending, and they don’t want to pay for anything.”