The House’s tax-writing Ways and Means Committee started debate Monday on the Republican Tax Cuts and Jobs Act, a four-day process that “could prove to be a make-or-break week,” as Bloomberg’s Sahil Kapur put it, in the GOP push to notch some sort of legislative win this year. This is the only time the House bill will be open for revisions, though the Senate is also expected to introduce its own tax bill later this week, which will likely raise additional points for debate but will also allow further opportunities for details both large and small to be changed.

“One of the big tests will be how far Senate tax writers can go on the corporate tax rate,” Politico’s Aaron Lorenzo notes. “It would permanently plunge to 20 percent from 35 percent in the House plan, but the Senate is hemmed in by budget constraints that the House isn’t.”

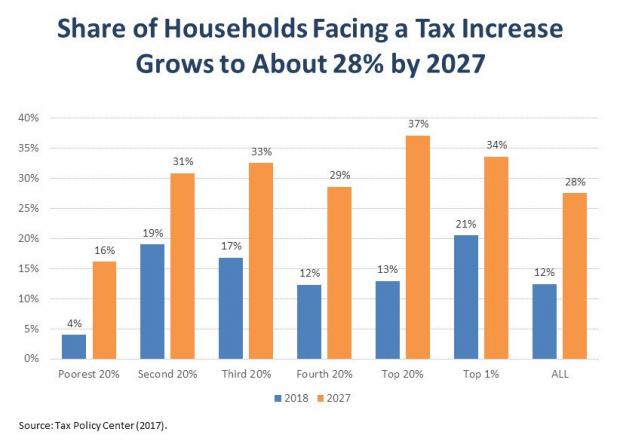

Nearly a Third of Taxpayers Will Pay More

The Republican sales pitch might have gotten a little bit harder Monday with the release of an analysis of the bill by the Tax Policy Center. Contradicting Mitch McConnell’s claim on Sunday that, “At the end of the day, nobody in the middle class is going to get a tax increase,” TPC found that a substantial number of middle-class taxpayers will pay more under the GOP plan: “not all taxpayers would receive a tax cut under this proposal—at least 12 percent of taxpayers would pay higher taxes under the proposal in 2018 and at least 28 percent of taxpayers would pay more in 2027.” UPDATE: The Tax Policy Center says its staff found an error in the report released Monday and is revising its analysis. We'll provide more information about the updated analysis once it's available.

The report will only add to criticism that the bill favors the wealthy. An analysis published last week by the Joint Committee on Taxation found that, on average, families making between $20,000 and $40,000 and those making between $200,000 and $1 million would face higher taxes by 2023. The JCT's chief of staff told the House Ways and Means Committee on Monday that 38 million households earning between $20,00 and $40,00 a year would see higher tax bills.

The conservative Tax Foundation released its own analysis on Friday which found that all income groups will get a tax break on average as a result of the bill. However, the report did not break income groups down to see if there were winners and losers within each group, with some paying more and others less.

One thing all of the analyses agree on: Most of the benefits of the tax bill go to the wealthy. Lily Batchelder, a professor at NYU law school and former deputy director of the White House National Economic Council under President Obama, tweeted: “Tax plan highly regressive even when look at % change in after-tax income, and becomes more regressive over time.”