With roughly a sixth of the U.S. population living in poverty and many more struggling to stay out of it, the federal social safety net has evolved in recent years into an extraordinarily costly and wide-ranging assortment of spending and tax measures.

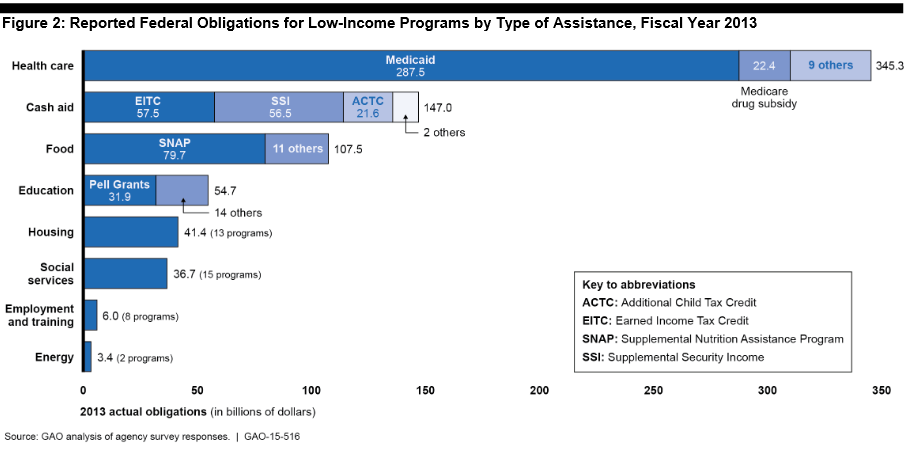

A new study by the Government Accountability Office provides a detailed inventory of federal welfare and social service programs identified 82 federal programs and assorted tax expenditures totaling $742 billion in fiscal 2013, the latest data available. An estimated 106 million people living in the U.S. – or about a third of the overall population – received benefits the previous year from at least one of eight programs for low income and very poor families that came in for special review by the GAO. Some of these programs are available to illegal immigrants.

Related: Why So Many Americans Are Trapped in ‘Deep Poverty’

With so much money at stake at a time of continued congressional concern about spending levels, these programs are certain to be scrutinized by the Republican-controlled Congress in the run-up to a new fiscal year on October 1. GOP leaders have already targeted many of these programs for cuts in the coming years, as they push for further sharp reductions in the deficit.

The giants in the programs include:

- Medicaid health care for an average of 57 million adults and children monthly and an annual cost of $287.4 billion.

- Federal food stamps for 23 million households a month at a yearly cost of $80 billion.

- Earned Income Tax Credits for 30 million annually at a cost of $57.5 billion.

- Supplemental Security cash assistance for 9 million people a year at a cost of $56.5 billion.

- Federal Pell Grants for 8.6 million college students at $31.8 billion a year.

- Temporary Assistance for Needy Families, the federal welfare program that provides benefits to an average of 3.5 million per month at an annual cost of $17.3 billion.

To give some perspective to the overall cost, the $742 billion annual figure represents nearly a third of the $2.4 trillion in total federal revenue that was collected in fiscal 2013 – and it doesn’t include the annual cost of Social Security or Medicare. GAO said the 2013 spending total was even higher if you counted four other tax provisions geared to helping low-income families and individuals, as well as the non-refundable portion of the Earned Income Tax Credit. Those provisions taken together drained the Treasury by $14 billion a year in foregone federal tax revenue.

Related: How to Dramatically Lower the Poverty Rate Overnight

Over the past decade, these programs have been a vital part of the government’s war on poverty as the nation’s low and moderate income families struggled in the Great Recession and a painfully slow economic recovery. Without these programs’ benefits, GAO says, about 25 million recipients would have fallen below the Census Bureau’s Supplemental Poverty Measure, which estimates poverty rates by examining a family's or an individual's cash income. In 2013, 48.7 million people -- 15.5 percent of the total population -- lived in poverty in the United States.

Of the eight programs that received special attention in the GAO study, the Earned Income Tax Credit and the food stamp program “moved the most people out of poverty,” although the majority of beneficiaries of each of the programs were estimated to have had incomes above the Supplemental Poverty Measure threshold. Just how effective these programs have been is a point of disagreement between Republicans and Democrats, and those questions almost certainly will be raised again this fall when the White House and GOP leaders sit down to negotiate a final budget deal for fiscal 2016 and decide whether to lift caps on domestic and defense spending called for under the 2011 Budget Control Act.

President Obama wants to lift the caps on both domestic and defense spending to expand on programs to help the middle class and low-income families, while Republican leaders on the House and Senate budget and tax-writing committees seeking a long-term balanced budget are arguing to retain the domestic caps as part of a final deal. That would mean deep cuts in many of the social safety-net programs.

Related: What Balanced Budget? GOP Pushes a 'Spend More' Blueprint

“I think the Republicans will definitely go after [those programs] for sure,” Ross Baker, a Rutgers University political and government professor and an expert on Congress, said in an interview on Monday. “Those programs have always been a prime target – going back to the difficulty Obama had in getting an extension of unemployment benefits. These programs are always on the chopping block as far as the Republicans are concerned. They see them as a kind of moral hazard.”

In assessing the value of the cornucopia of federal welfare and social assistance programs, the GAO said that, “Research suggests that assistance from selected means-tested low-income programs can encourage people's participation in the labor force, but have mixed effects on the number of hours they work.”

Part of the problem has to do with the interaction between a complex tax and benefits system and efforts by low-income people to better themselves through increased labor. The Catch-22 in all of this is that as their income rises, they are hit with reductions in the federal support – often times a zero sum game for beneficiaries.

“Changes in certain low-income programs through the years, including the EITC, have enhanced incentives for people to join the labor force,” the report says, citing other studies. “While workers who receive means-tested benefits face benefit reductions as their earnings rise, research shows that various factors limit how much people change their work behavior in response…. Research also shows that enhancing work incentives can create difficult policy trade-offs, including raising program costs or failing to provide adequate assistance to those in need.”