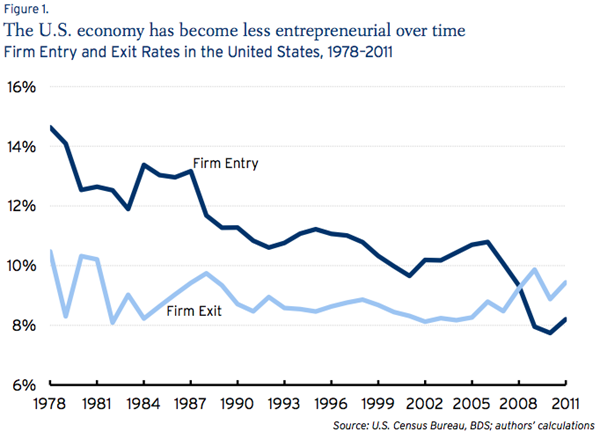

Startup nation continues to be mired in stagnation. American entrepreneurship has been on a decades-long decline, one that’s belied by the rise of new household names like Google, Facebook and even Uber. Starting a new business has supposedly never been easier, yet more businesses are dying than are being created and new businesses keep shrinking as a share of all companies. As a result, just as the American population has been aging, American businesses have as well.

Related: Why Google and Uber Are Playing Badly in Europe

The trend has been clear for a while, but the reasons for it haven’t been. As economists Ian Hathaway of Ennsyte Economics and Robert Litan of the Brookings Institution put it in a new paper published last week:

“How could it be that the American economy, built on the sweat and ingenuity of some of history’s greatest entrepreneurs, now have more businesses closing each year than new ones opening doors? And with all of the seeming technological disruption and popularity of entrepreneurship around, how could it be that mature firms are more entrenched than at any point in at least the last couple of decades?”

The two economists answered those questions by offering what they described as a partial explanation.

Their report honed in on two factors. The first relates to demographics, but probably not in the way you might think. To wit: One possible explanation for the decline in entrepreneurship is that America’s aging has resulted in a smaller share of the population in the prime ages for entrepreneurship, 35 to 44 years old. The economists found that the changes in that population don’t match up neatly with changes in the rate of new firms being started. “So, while an increase in this portion of the population might be a boost to startups in the future, we don’t believe it played a role in the recent decline,” they write.

Related: More Americans Are Quitting Their Jobs…and That’s Great News

Instead, they say, their study of startup rates over a three-decade period highlighted a different aspect of U.S. demographics as driving the decline of startups. “Slowing population growth in the West, Southwest, and Southeast regions since the early 1980s appears to be a major factor,” they write. “When the rate of population growth in these regions began to decline, so did the rates of firm formation—declining most, on average, in these previously higher-growth regions.”

The second driver Litan and Hathway key in on is the consolidation that has left larger companies dominating the business landscape. The authors studied business formation data for three decades across the 50 states and more than 350 metropolitan areas. They found that areas that experienced more business consolidation — greater activity in businesses with multiple locations — also saw greater declines in entrepreneurship. Bigger, more established businesses seemingly made it harder for little guys to break in, or even to try.

Related: Man and Uber Man: Do Startup CEOs Have to Be Jerks?

J.P Morgan economist Michael Feroli raised a similar point in a note to clients last week that looked at why we haven’t seen more entrepreneurs lured into starting up new enterprises given the high profit margins businesses have enjoyed as the expansion continues. “One hypothesis is that those elevated margins owe to natural monopoly profits, perhaps due to an increased prevalence of network effects,” Feroli wrote. In other words, the more people use, say, Facebook, the more entrenched and dominant it becomes and the less likely someone else may be to create a David to take on that incumbent Goliath. “In this case, the incumbent profits are incontestable, and start-up activity shouldn't be expected to increase,” Feroli said.

Related: A Startup You’ve Never Heard of Is Changing the Internet

Other factors beyond population growth and business consolidation have also played significant parts in the decline of entrepreneurship, and Hathaway and Litan caution that more research is needed to clarify what’s been driving the trend, and whether the correlations they find really are evidence of causation.

Even so, they argue, their findings suggest some policy remedies that could boost the number of new startups and thus help the job market and the U.S. economy more broadly, including one recommendation that’s particularly relevant to the debate going on in Washington, D.C. right now: Letting more high-skilled immigrants into the U.S.

Related: Obama May Have Tied the GOP’s Hands on Immigration

That wouldn’t just reverse slowing population growth. “We know that immigrants generally have a greater propensity to launch new business — high-tech businesses in particular,” the economists write. For that reason, they argue, the D.C. debate on immigration reform should focus on this group first.

Top Reads from The Fiscal Times:

- Why Wall Street Breeds So Many Bad Apples

- The So-So Society: Democrats Have Forgotten What Made Them Great

- There Are Now 69,560 Americans Worth $30 Million or More