Biden Requests $33 Billion More for Ukraine. Congress Could Make It Complicated

President Joe Biden on Thursday asked Congress for $33 billion in emergency military, economic and humanitarian assistance to Ukraine, urging lawmakers to quickly provide additional support for the country as it fights Russia’s invasion. But congressional disputes over Covid funding and immigration policy could complicate a bipartisan desire to deliver more aid to Ukraine.

"We need this bill to support Ukraine in its fight for freedom. And our NATO Allies, our EU partners — they’re going to pay their fair share of the costs as well, but we have to do this. We have to do our part as well, leading the Alliance," Biden said. "The cost of this fight is not cheap, but caving to aggression is going to be more costly if we allow it to happen."

According to a White House statement, Biden’s request includes $20.4 billion in military assistance for Ukraine, $8.5 billion in economic assistance meant to help the Ukrainian government continue to function and provide basic services and $3 billion in humanitarian aid, which includes assistance to Ukrainians displaced by the war and food support for developing countries hurt by the disruption of Ukrainian supplies of wheat and other crops.

The president’s request also seeks another $500 million to support the production of U.S. food crops that are seeing global shortages as a result of the war. And it proposes giving U.S. authorities expanded power to seize the assets of Russian oligarchs — and then liquidate those assets, with the proceeds going to benefit Ukraine.

Biden said the U.S. has nearly exhausted the $13.6 billion in funding provided by Congress in March. "Basically, we’re out of money," he said.

The new $33 billion request is meant to cover the costs of supporting Ukraine through the rest of the current fiscal year, which ends September 30. As emergency supplemental spending, the additional outlays would not have to be offset by spending cuts elsewhere.

Biden’s ask already faces congressional hurdles: The president called it critical that the additional aid funding gets approved as quickly as possible, and though the assistance has bipartisan support, lawmakers are already wrangling over just how it might be passed.

As we outlined yesterday, the fate of the Ukraine aid might be tied to an additional round of Covid-19 funding, if Senate Majority Leader Chuck Schumer (D-NY) and Democrats decide to package the two together in an effort to counter Republicans’ linking of the coronavirus money to keep in place Title 42, a Trump-era pandemic border policy allowing for the quick expulsion of migrants.

In his request Thursday, Biden again urged Congress to provide another $22.5 billion for Covid vaccines, testing and treatment. "To avoid needless deaths in the United States and around the world, I urge the Congress to include this much needed, life-saving COVID funding as part of this supplemental funding request," Biden wrote, tying the two funding requests together.

Asked later whether the Covid and Ukraine aid packages should be bound together legislatively, Biden said, "Well, I don't care how they do it. I'm sending them both up. I mean, they can do it separately or together. But we need them both."

Some Republicans warned against linking the two aid bills. "[Schumer] thinks he can leverage support for Ukraine to get Covid supplemental funding. But I’m just saying, as a practical matter, I don’t think that’s a good move for him, because I think that our members are very much interested in having those votes separately," Senate Minority Whip John Thune (R-SD) told Politico, adding, "And if he tries to link them, it probably dooms both."

If Democrats do link the two packages, Republicans would likely demand a vote on the GOP amendment to keep Title 42, again placing Democrats in a bind.

Senior Democrats reportedly insist they won’t let the aid to Ukraine be delayed, but some Senate Democrats told Politico they expect Schumer to pair the two funding bills. "In the near term, many Democrats appear willing to dare Republicans to vote down a bill that includes the much-needed Ukraine military assistance," Politico’s Andrew Desiderio reports.

Considerations about the best legislative path for the aid must also factor in the House, where Desiderio says that the Congressional Progressive Caucus and Hispanic Caucus are indicating that at least some of their members would oppose a package that also includes Republican language blocking the Biden administration from ending the Title 42 immigration restrictions. House Majority Leader Steny Hoyer (D-MD) told reporters Wednesday that that the Ukraine bill is urgent enough to move on its own.

The bottom line: Republicans have insisted on linking additional Covid aid to Title 42. Now Democrats have a decision to make about whether to tie the pandemic funding to Ukraine aid.

Economy Shrinks to Start 2022. Biden — and Many Economists — Say They’re Not Worried

The U.S. economy contracted by 0.4% in the first three months of 2022, for a growth rate of -1.4% on an annual basis, the Bureau of Economic Analysis announced Thursday, in what is the first negative GDP report since the early days of the pandemic two years ago.

While the report shows a sharp contrast with the preceding months, when the U.S. recorded strong growth, most economists are saying the negative results are not a cause for alarm.

"The report isn’t as worrisome as it looks," writes Lydia Boussour of Oxford Economics. "Beneath the weak headline print, the details point to an economy with solid underlying strength that demonstrated resilience in the face of Omicron, lingering supply constraints and high inflation."

Technical factors in play: In remarks at the White House, President Biden blamed "technical factors" for the downbeat numbers, and according to Bloomberg’s Jordan Fabian and Chris Anstey, he is basically correct.

"GDP in the first three months of this year was walloped by one of the biggest hits from trade in the post-World War II era," Fabian and Anstey write. "That’s because American businesses and consumers bought a lot of foreign products, at a time when most other economies aren’t buying U.S. goods at the same pace."

The increase in purchases of foreign goods is a sign of an extremely hot economy, says Joseph Brusuelas, chief economist at the consulting firm RSM. "Despite the 1.4% contraction, personal consumption up 2.7%. Investment increases 7.3% as activity in the real economy remains remarkably stout," he writes. "To put it bluntly the economy is expanding at such a brisk pace that Americans turned to external sources to meet demand."

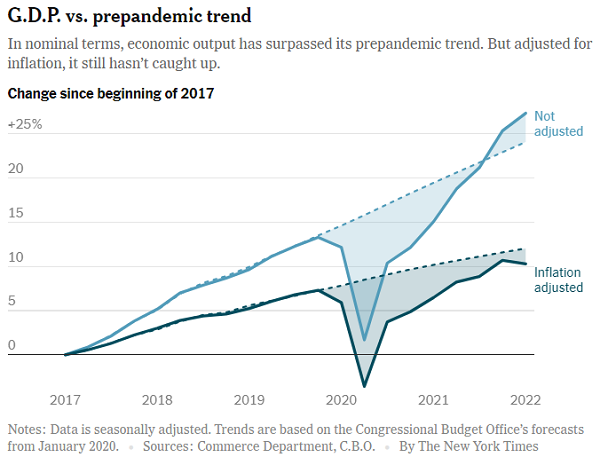

Inflation takes a bite: Inflation also played a major role in the negative result. In non-inflation-adjusted terms, the economy grew by 1.6%, indicating that consumers and businesses spent more in the first quarter than the quarter before. But inflation ate away at the real value of those purchases, producing an inflation-adjusted decrease. (See the chart below for the big gap between real and nominal GDP growth.)

"The growing gap between what economists call ‘real’ (inflation-adjusted) and ‘nominal’ (unadjusted) growth reveals a lot about the complicated state of the U.S. economy," says The New York Times’ Ben Casselman. "Demand for just about everything is exceptionally strong: Consumers want cars and houses and meals at restaurants; companies want workers and materials so they can sell them those things."

Politically, though, the fact that inflation is so strong and persistent could prove to be a burden for Democrats. Senate Republican leader Mitch McConnell (R-KY) charged that "runaway inflation is crushing working American families on Democrats’ watch," adding that his opponents have "thrown the recovery into reverse and we’re actually going backward."

Recession still unlikely – for now: While a handful of analysts are predicting a recession — Deutsche Bank this week forecasted a "major recession" in the U.S. next year driven by Federal Reserve tightening — most say it’s too early to make any such predictions. "Don’t panic. This is not the start of a recession," Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote Thursday. "The weakness in GDP growth was due to wild components."

Gus Faucher, chief economist at PNC, said in a note, "Although GDP fell in the first quarter, the U.S. economy is not in recession. Underlying demand remains strong, and the labor market is in excellent shape."

Still, the report did increase worries about the Fed’s ability to deliver a soft landing as it attempts to bring down inflation. "When the Fed has to raise interest rates as far as they say they’re going to, recession risks are high," Mark Zandi, chief economist at Moody’s Analytics, told The Washington Post. "There’s just no graceful way for the economic plane to land on the tarmac. It might land without crashing, but it’s going to be a scary ride."

At the White House, Biden downplayed the threat of a downturn. "I’m not concerned about a recession. I mean, you're always concerned about a recession," he said. "No one is predicting a recession now. Some are predicting there may be a recession in 2023."

Biden also called on lawmakers to take steps to help head off any burgeoning economic weakness by enacting his agenda. "Congress should send to my desk a bipartisan innovation bill to bolster our supply chains and make more in America," he said. "And Congress needs to pass legislation to lower costs and lower the deficit …"

But interest rate hikes are still as likely as before: "For those who think this data will cause policymakers at the Federal Reserve to hesitate on their plans to push the policy rate well above the terminal rate of 2.5% by the end of the year, think again," Brusuelas writes. "First-quarter growth data underscores that policy direction and will most likely add to the urgency at the central bank to move decisively."

Quote of the Day

"Despite its progress, the IRS has yet to develop and adopt a one-stop solution for online and digital offerings that combines communications and interactions with individual and business taxpayers as well as with tax professionals. Imagine what the IRS can accomplish and how much time and effort it could save if taxpayers could easily access their tax information online. I would like to stop merely imagining this; the IRS needs to have robust online accounts available for all taxpayers and tax professionals that provide information, guidance and the capability to work and resolve issues online."

— National Taxpayer Advocate Erin M. Collins, writing Thursday about the need to improve online service for taxpayers at the IRS.

News

- Biden Seeks $33 Billion for Ukraine, Powers to Liquidate Russian Assets – Washington Post

- White House’s $33B Ukraine Aid Bid Already Tangled Up in Congress – Politico

- Biden’s Ukraine Aid Risks Slowdown as GOP Balks at Covid Tie-In – Bloomberg

- U.S. Economy Posts Surprise Contraction, Belying Solid Consumer Picture – Bloomberg

- Economy Shrinks 1.4% in First 3 Months of Year, Raising Recession Fear – Washington Post

- White House Plays Down First-Quarter Growth Decline – New York Times

- Drop in US GDP Challenges Biden’s Pitch to Voters – Associated Press

- Yellen Says More Shocks Likely to ‘Challenge the Economy’ – Associated Press

- Biden Eyes Student-Loan Forgiveness, Spurns $50,000 Schumer Plan – Bloomberg

- Senators Relaunch Bipartisan Immigration Discussions – Roll Call

- Medicare Advantage Plans Often Deny Needed Care, Federal Report Finds – New York Times

- Once Dead, Twice Billed: GAO Questions COVID Funeral Awards – CBS News

- US Left Behind $7 Billion of Military Equipment in Afghanistan After 2021 Withdrawal, Pentagon Report Says – CNN

- Moderna Asks FDA to Authorize Covid Vaccine for Children Under 6 – NBC News

- Behind the Scenes, Disney Fights the Repeal of Its Special Tax Status – Washington Post

Views and Analysis

- The Biden Boom Turns Into a GDP Bust – Kate Davidson, Politico

- To Avoid Recession, Everything Needed to Go Right. It Hasn’t – Catherine Rampell, Washington Post

- The U.S. Wants to Tackle Inflation. Here’s Why That Should Worry the Rest of the World – Jamie Martin, New York Times

- Dismal GDP Report Raises the Odds of a Recession This Year – Gary Shilling, Bloomberg

- Covid Funding Has Become a Gambit on Capitol Hill – Rachel Roubein, Washington Post

- "It Would Be Huge": Democrats Cheer Biden’s Baby Steps on Canceling Student Debt – Grace Segers, New Republic

- The Economy is Great. The Middle Class is Mad – Alana Semuels and Belinda Luscombe, Time

- Don’t Forget the Afghan Refugees Who Need America’s Support – Washington Post Editorial Board

- War Is a Dirty Business. Will the Marine Corps Be Ready for the Next One? – Charles Krulak, Jack Sheehan and Anthony Zinni, Washington Post

- IRS Online Accounts Do Not Have Sufficient Functionality and Integration With Existing Tools to Meet the Needs of Taxpayers and Tax Professionals – Erin M. Collins, National Taxpayer Advocate