The results of “the cost-sharing revolution” in health care — the decades-long shift of an increasing share of medical expenses onto patients, even for those with insurance — are not encouraging, a new report from The Los Angeles Times and the nonprofit Kaiser Family Foundation finds: “Soaring deductibles and medical bills are pushing millions of American families to the breaking point, fueling an affordability crisis that is pulling in middle-class households with health insurance as well as the poor and uninsured,” Noam Levey of The Los Angeles Times wrote Thursday.

Levey said that annual deductibles in employer-based health plans have nearly quadrupled in the last 12 years, and now average more than $1,300. However, more than 40% of workers in high-deductible plans lack the savings to cover such an expense. As a result, a significant number of Americans with job-based insurance are cutting back on household spending, delaying doctor’s visits or skipping care entirely.

Some key numbers from the Kaiser Family Foundation/LA Times Survey:

- 25% of workers say they or an immediate family member struggled to pay their medical bills before meeting their deductible over the last year;

- 26% say they cut back spending on food, clothing and other basic items to pay for health care costs;

- 33% say they postponed needed care in the last year;

- 20% say they or an immediate family member struggled to pay surprise medical bills;

- 19% say they used up all or most of their savings to pay for care.

“There has been a quiet revolution in what health insurance means in this country. This happened under the radar while everyone was focused on the Affordable Care Act,” Kaiser’s Drew Altman said. “We forgot that most people get their insurance through an employer, and for them, the issue is medical bills that they increasingly cannot afford.”

A new study by the American Cancer Society reinforces the point, finding that most American adults have experienced some kind of hardship related to medical expenses. About 56 percent of Americans aged 18 and older who participated in the 2015–2017 National Health Interview Survey said they had experienced a medical financial hardship in the last year. That translates to roughly 137 million people struggling to pay medical bills, delaying care and/or worrying about how to afford the care they need.

“High patient out-of-pocket (OOP) spending for medical care is associated with medical debt, distress about household finances, and forgoing medical care because of cost in the USA,” the report said.

Adults aged 18 to 64 years old reported more problems than those 65 and over. Ill health, lower educational levels and a lack of insurance were all associated with increased levels of hardship, the report said.

The researchers said there’s reason to believe the problem will only get worse. “With trends towards higher patient cost-sharing and increasing health care costs, risks of hardship may increase in the future,” the report concluded.

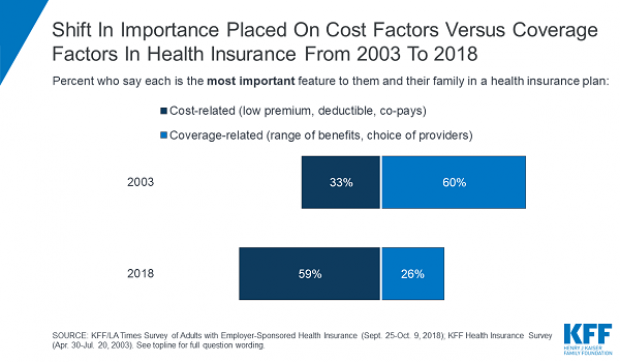

A Huge Shift Over 15 Years

The rising concern about cost can be seen in the response to a survey question Kaiser asked in 2003 and again in 2018. In the first survey, 60% of respondents said the range of benefits and choice of providers was most important. Only 33% cited cost. Fifteen years later, the numbers were nearly reversed, with 59% saying that cost was the most important feature in a health insurance plan and just 26% citing coverage-related issues.