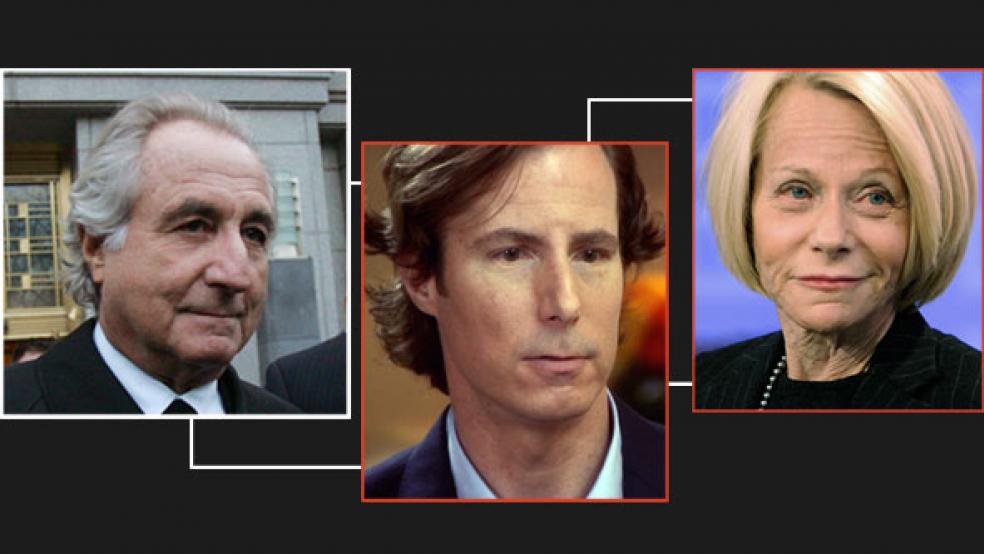

Bernie Madoff never told his wife, Ruth, or his two sons, Andrew Madoff and Mark Madoff, that he was running a $65 billion Ponzi scheme that destroyed the financial lives of thousands of people and resulted in the suicide of his first-born son, says Diana B. Henriques, the first reporter to interview Bernie Madoff in prison. Henriques, who wrote The Wizard of Lies, an analysis of the Madoff case, says it’s time once and for all to believe the family's emphatic denials.

“Ask any dumped spouse: Every family has secrets,” Henriques told The Fiscal Times. “There are tons of examples of people who have kept remarkable secrets from their nearest and dearest, out of shame, out of embarrassment, out of conventionality. This was a guy who was staring down the barrel of a prison sentence. He had every reason in the world to keep [his financial scam] a secret. And who would be easier to fool than the people who trusted you most?”

Ruth Madoff and her surviving son Andrew are telling their side of the story through a new book, which they promoted on "60 Minutes" last Sunday. The book contains detailed interviews with family members. Bernie Madoff himself did a recent high-profile interview with Barbara Walters, all of which has reignited public interest – and anger – in the case.

Madoff, 73, a former chairman of Nasdaq, is serving a 150-year prison term after pleading guilty to securities fraud in 2009. He has always maintained that his wife and sons were completely in the dark about the fraud that wiped out the life savings of thousands of investors – the largest Ponzi scheme in history.

Still, Henriques – who for years has maintained contact with Madoff through letters, emails and phone calls – says she can’t believe the continued public fascination with “this soap opera.”

The Fiscal Times (TFT): So why do we care so much, even in the fall of 2011 – what’s at work here?

Diana B. Henriques (DBH): The family has finally entered the conversation. I tried repeatedly to get on-the-record interviews with the Madoff family for my book and struck out every time. Madoff himself has been driving the narrative. He’s been giving interviews; he’s been opining about this and chatting with Barbara Walters about it – so he’s been out there.

TFT: The family has been kept under wraps until now, you believe.

DBH: Yes, from the beginning, by their lawyer, and then by their own estrangements. These are people about whom the public had become increasingly curious, people they knew next to nothing about – and finally they’re speaking up. So it’s the novelty of that.

TFT: You’ve said from the beginning that you believed Ruth and the Madoff sons were innocent and did not know about the Ponzi scheme – that they were taken by surprise by it as much as anybody else was. Why do you believe that?

DBH: When her husband confessed in [the family’s] study [in December 2008], ‘I’m running a Ponzi scheme,’ Ruth’s stunned reaction was, ‘What’s a Ponzi scheme?’ According to her son, Andrew, neither Andrew nor Mark ever believed their mother knew anything about it. It’s inconceivable that Madoff would have relied on them. The emotional logic did not make sense to me from the beginning. The circumstantial evidence never added up to guilty knowledge on their part. And what we’ve learned both about their personalities and about their memories of those days bears that out. They did not learn about this fraud until Bernie Madoff told them about it.

TFT: So you find their new denials completely credible?

DBH: They’re facing a very difficult task: The public expects them to prove a negative – prove you didn’t know then something that you do know now. Not one of us could do that! It’s not even possible to measure the truthfulness of a statement like that on a polygraph. So, I don’t know that they’ll ever win the public’s agreement with that. But certainly it’s not so much that their denials are credible – it’s that there still isn’t any evidence that they knew.

TFT: So at some point you want to say to the skeptics –

DBH: I want to say, If you think they’re guilty, prove it.

TFT: What surprised you the most when you first met Madoff?

DBH: I’ve covered other Ponzi schemers in my career, and typically they’re very charismatic – the most charming person in the room. Madoff was not. He’s very calm, very quiet. He makes you feel like you’re the most charming person. And since you’re so bright and wonderful, why would you ever doubt your wisdom in trusting him?

TFT: Yet even when people were suspicious about the returns they were seeing on their investments, time and again he was able to reassure them. How?

foolish thing, I lost all your

money,’ Madoff bought their

investments back at the price

they’d paid. That was in 1962.”

DBH: He had a gift for inspiring confidence. It served him well in his legitimate business, I must say. It’s what made him a trusted advisor to the SEC for many years; it’s what gave him stature in industry circles and organizations.

TFT: You say in your book that he first turned to deceit as far back as 1962.

DBH: In 1962 he invested a small group of clients’ money in newly issued, over-the-counter stocks, a very reckless category. The market hit an air pocket and the stocks went to almost nothing. The clients, mostly family and friends, lost everything. But rather than say, ‘Listen, I did a foolish thing, I lost all your money,’ he bought their investments back at the price they’d paid.

TFT: So they came through it.

DBH: And he got away with it. Everyone else was losing money. But they said, ‘Wow, Madoff is a genius.’ It laid the foundation for all that came later in his life of crime. I can’t say that it was the start of the Ponzi scheme, though.

TFT: Still, you say the Ponzi scheme started far earlier than Madoff admits.

DBH: The best evidence suggests that the Ponzi scheme was probably in place in the mid 1980s on a large scale. He says it didn’t begin until 1992. But I asked him about the year 1987. His legitimate firm came through the crash of 1987 pretty well, but his big investors were frightened by the market’s volatility and wanted to take substantial amounts of money out of their accounts. Madoff had trouble meeting the withdrawals. He was upset. At just that moment a huge wave of hedge fund money came into his hands from offshore accounts. I said, ‘Bernie, wasn’t it just the tiniest bit tempting to take some of that money and give it to the old-time investors to cover their withdrawals?’ ‘Oh, no,’ he said. ‘No.’ He flatly denied the Ponzi scheme started then. But you can see why I’m suspicious.

TFT: Were there questions he refused to answer?

DBH: In February he brushed off any questions about his son Mark’s death. He did talk about it later to The Financial Times, which probably benefitted from being a little farther removed from the event.

TFT: What about his wife, Ruth, and his other son, Andrew – did he talk about them?

said, ‘I didn’t tell

Ruth she had to stay

with me. But somehow

she found the compassion.’

DBH: In our first interview I asked him if he regretted Ruth’s decision to stay with him after his arrest, given how much vitriol came her way as a result. He started to cry. He broke down. He said, ‘I didn’t tell her she had to stay with me. But somehow she found the compassion.’

TFT: You say he was baffled that people thought his family was involved in his crime.

DBH: He knew they would be financially and socially ruined – he’s not naïve – but he didn’t expect they would be accused of being accomplices.

TFT: Can people ever be sure they won’t be swindled by the next Bernie Madoff?

DBH: You can never be sure of that. But we overestimate our ability to recognize risk, and to make gut judgments about who is trustworthy and who isn’t. We’re desperate for someone to help us. If we’re going to invest on trust, we should invest in an arena that’s as tightly regulated as possible. Remember: Madoff was running an unregistered secret hedge fund run by an unregistered investment advisor who didn’t provide any paperwork. In what universe is that a safe investment for a middle-class investor? I talked to people who were wiped out. It’s tragic. I gently asked them, ‘Why Madoff? Why not a bank CD, or a public mutual fund? This was money you could not afford to lose.’

TFT: And what did they say?

DBH: ‘Oh, well, I couldn’t make enough money with those.’ So they trusted Bernie, and they had all their eggs in one basket – yet the first rule of investing is ‘diversify.’

TFT: Individual investors should do what, then, in your view?

DBH: They should ask their money manager, ‘Do you use an independent third-party custodian?’ And if the answer is no, they should get up and walk right out the door.

Parts of this interview were on April 30, 2011.