House Democrat Calls Congress ‘The Poster Child for Cowardice” on ISIS

Amid growing signs that the U.S. faces nothing but bad choices in its war against ISIS, Rep. Jim McGovern, a liberal Democrat from Massachusetts, today denounced Congress as “the poster child for cowardice” for refusing to debate a new war powers resolution to set parameters for the Obama administration’s efforts to “degrade and defeat” the jihadist terrorists in Iraq and Syria.

At the behest of Republican and Democratic leaders, Obama sent a proposed war powers resolution to Congress in February outlining his core objectives of systematically destroying the jihadist terror group through a sustained campaign of airstrikes, supporting and training allied forces on the ground and humanitarian assistance – but without committing a large number of U.S. combat troops to the effort.

Related: U.S. Shoots Itself in the Foot By Accidentally Arming ISIS

The administration proposal would give the military “flexibility” to confront unforeseen circumstances, potentially by deploying Special Forces in the region. But it would limit the mission to three years and would not authorize “enduring offensive ground combat operations.”

But rather than roll up their sleeves and debate and vote on the president’s request for new military authorization, Republican leaders have effectively shelved the issue and moved on to other things, such as rewriting the rules for NSA spying on Americans’ phone calls and providing Obama with fast track authority to negotiate a new trade pact with Asian countries.

With many conservative Republicans including Sens. John McCain of Arizona and Lindsey Graham of South Carolina complaining that the president’s strategy for defeating ISIS woefully inadequate and some Democrats worried that it goes too far in committing U.S. troops and resources to a no-win situation in the Middle East, Senate Foreign Relations Committee Chair Bob Corker (R-TN) said recently he had no incentive to take up the issue in his committee.

Related: Why Congress Should Simply Bag the War Powers Debate

Frankly speaking, this is unacceptable,” McGovern, a member of the House Rules Committee, said on the House floor today, adding that if the Congress “doesn’t have the stomach” to authorize the war it should vote to bring U.S. forces home, according to Politico. McGovern introduced a bipartisan resolution that would require full debate within 15 days on whether U.S. troops should withdraw from Iraq and Syria. His bipartisan resolution is co-sponsored by Reps. Walter Jones (R-NC) and Barbara Lee (D-CA).

“This House appears to have no problem sending our uniformed men and women into harm’s way,” McGovern said in prepared remarks. “It appears to have no problem spending billions of dollars for the arms, equipment and airpower to carry out these wars. But it just can’t bring itself to step up to the plate and take responsibility for these wars.”

Economists See More Growth Ahead

Most business economists in the U.S. expect the economy to keep chugging along over the next three months, with rising corporate sales driving additional hiring and wage increases for workers.

The tax cuts, however, don’t seem to be playing a role in hiring and investment plans. And the trade conflicts stirred up by the Trump administration are having a negative influence, with the majority of economists at goods-producing firms who replied to the most recent survey by the National Association for Business Economics saying that their companies were putting investments on hold as they wait to see how things play out.

New Tax on Non-Profits Hits Public Universities

The Republican tax bill signed into law late last year imposed a 21 percent tax on employees at non-profits who earn more than $1 million a year. According to data from the Chronicle of Higher Education cited by Bloomberg, there were 12 presidents of public universities who received compensation of at least $1 million in 2017, with James Ramsey of the University of Louisville topping the list at $4.3 million. Endowment managers could also get hit with the tax, as could football coaches, some of whom earn substantially more than the presidents of their institutions.

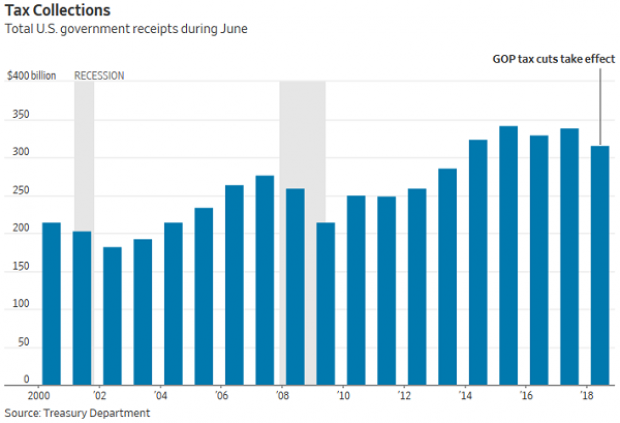

Government Revenues Drop as Tax Cuts Kick In

Corporate tax receipts in June were 33 percent lower than a year ago, according to data released by the Treasury Department Thursday, as companies made smaller estimated payments due to the reduction in their tax rates. Total receipts were down 7 percent, while payroll taxes were 5 percent lower compared to June 2017.

“June receipts to US government were our first mostly-clear look at the revenue effects of the new tax law, with lots of estimated payments and little noise from the 2017 tax year,” The Wall Street Journal’s Richard Rubin tweeted Friday.

Surprisingly, the deficit was smaller in June compared to a year ago, narrowing to $74.86 billion from $90.23 billion last year. The drop was driven by a 9 percent reduction in government outlays that reflected accounting changes rather than any real changes in spending, Rubin said in the Journal.

“More broadly, the federal deficit is swelling as government spending outpaces revenues,” Rubin wrote. “The budget gap totaled $607.1 billion in the first nine months of the 2018 fiscal year, 16% larger than the same point a year earlier.”

Kyle Pomerleau of the Tax Foundation pointed out that the drop in corporate tax receipts is a permanent feature of the Republican tax cuts, tweeting: “Even in a Trump dream world in which these cuts paid for themselves, corporate tax collections would remain below baseline forever. It would be higher income and payroll receipts that made up the difference.”

Deficit Jumps in Trump’s First Fiscal Year

The federal budget deficit rose by 16 percent in the first nine months of the 2018 fiscal year, which began last October. The shortfall came to $607 billion, compared to $523 billion in the same period the year before, according to a U.S. Treasury report released Thursday and reported by Bloomberg. Both revenue and spending rose, but spending rose faster. Revenues came to $2.54 trillion, up 1.3 percent from the same nine-month period in 2017, while spending came to $3.15 trillion, up 3.9 percent.

Where’s the Obamacare Navigator Funding for 2019, PA Insurance Commissioner Asks

Pennsylvania’s insurance commissioner sent a letter this week to Health and Human Services Secretary Alex Azar and Centers for Medicare and Medicaid Services (CMS) Administrator Seema Verma requesting that they “immediately release the funding details for the Navigator program for the upcoming open enrollment period for 2019.” Navigators are the state and local groups that help people sign up for Affordable Care Act plans.

“In years past, grant applications and new funding opportunities were released by CMS in April, CMS required Navigator organizations to apply by June and approved applications and new funding by late August,” Pennsylvania’s Jessica Altman wrote. “The current lack of guidance has put Navigator organizations – and states - far behind in their planning and creates an inability for the Navigator organizations to design a successful plan for helping people enroll during the 2019 open enrollment period.”