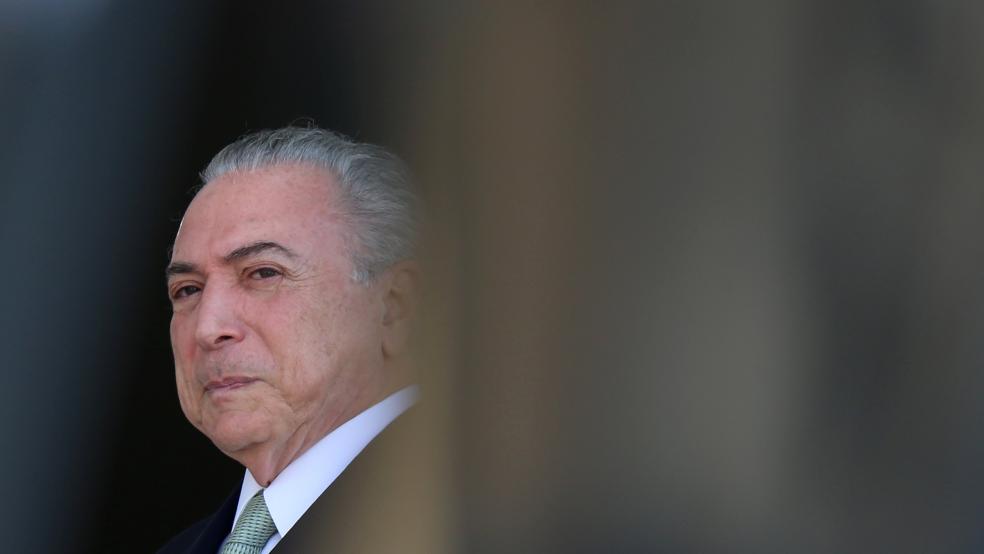

BRASILIA (Reuters) - Brazil's main opposition party obstructed a key measure of President Michel Temer's economic agenda on Tuesday, delaying a congressional committee vote by one day on a proposal to create a market-based benchmark for state lender BNDES.

Temer's allies were confident the measure would still be approved on Wednesday morning, in time for a final vote by both houses of Congress before the September 7 deadline.

The obstruction nevertheless highlighted risks to Temer's legislative agenda as a lingering corruption scandal and a looming presidential election opens rifts within his coalition.

Brazil's currency

weakened 0.4 percent against the U.S. dollar, reversing earlier gains as investors feared for the strength of Temer's coalition in Congress.The proposal is one of Temer's top priorities to fix the country's long-term public finances and pave the way for lower interest rates as it reduces the scope for discretionary subsidies through BNDES lending. Temer is also seeking Congress support for softened budget targets for 2017 and 2018, a major overhaul of pension rules, and has recently floated the idea of changing the country's presidential regime to a parliamentary system. Tuesday's committee session was abruptly ended by the committee chairman, Senator Lindbergh Farias from the minority Workers' Party, who requested detailed information on the fiscal impact of the proposed benchmark.Exasperated at the decision, members of Temer's coalition threatened to appeal to the Senate president. After nearly one hour of discussions, government and opposition leaders agreed to resume the session on Wednesday at 9 a.m. local time."If he (Farias) does not open the session tomorrow at 9 a.m. sharp, we will find another chairman," André Moura, the government leader in Congress, told journalists.BNDES, the main provider of long-term corporate loans in Brazil, has offered cheap loans for decades to boost economic growth and create jobs. Rising public debt and increased scrutiny of the bank's lending policies after corruption scandals have led policymakers to propose changes, such as the new market-based benchmark, to boost transparency.The new rate, known as TLP, was proposed in April through a provisional decree. Temer's coalition had hoped to approve it by a large margin of 18-8 at the committee, the bill's sponsor, representative Betinho Gomes, said on Monday. (Reporting by Silvio Cascione; editing by Diane Craft)