(Reuters) - One of the Federal Reserve's most dovish officials said on Friday that September may turn out to be the right time to raise interest rates if the U.S. economy continues to improve, and he set a relatively high hurdle for delaying the move until next year.

Boston Fed President Eric Rosengren said in an interview that while wild cards remain - including the recent drop in oil prices, China's economic slowdown, and the ongoing Greek debt crisis - the U.S. central bank could move to tighten policy at any upcoming meeting, including one in mid-September."I don't rule out any of the meetings from here on out," Rosengren told Reuters by phone. "If we do continue to get improvement in labor markets, if we do become reasonably confident that we're moving back to 2-percent inflation, it may be appropriate as early as September," he said of raising rates from near zero. "I don't think we have seen that evidence yet but we still have a couple months of data to see whether it's more strongly confirmed."Rosengren has long advocated for more monetary accommodation than most of his colleagues at the central bank, which has kept interest rates at rock bottom to boost the recovery. With wages showing early signs of a pick-up and U.S. unemployment down to 5.3 percent, he set a high bar for delaying a hike.Only if labor markets unexpectedly weaken, if core inflation starts to drop off, or if the wage gains dissipated, "those would be the things that would make me want to pause and wait and see whether there is further evidence," he said.Rosengren, who does not have a vote on policy this year, predicted core personal consumption expenditure (PCE) inflation to rise to 1.3 percent by year end, from 1.2 percent now, and for it to hit about 1.6 percent by the end of 2016.He expects gross domestic product (GDP) to rebound to about 2.75 percent in the second half of this year. "But that could certainly go off track if we get an international shock that changes people's confidence," he said.The predictions, he said, show "only modest" improvement in inflation and they assume some tightening in labor markets. "That might make me start tightening, but exactly what the timing of that occurs depends" on incoming data, he added. If "international shocks turn out to not to be negative at all that would be very good news," Rosengren said. (Reporting by Jonathan Spicer; Editing by Diane Craft)Fed rate hike may come as early as September, Rosengren says

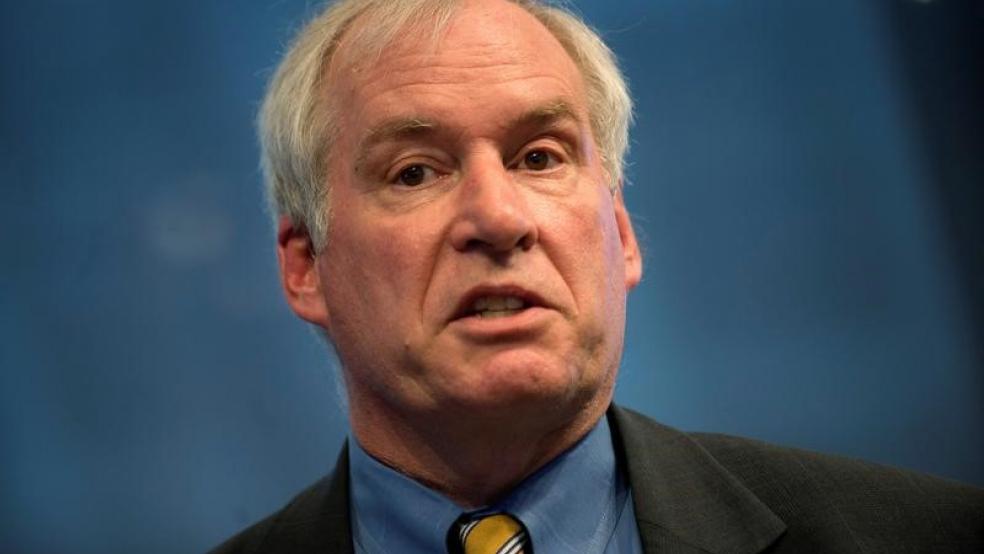

Keith Bedford