If there is a patron saint on Wall Street, it's got to be former Federal Reserve Chair Ben Bernanke.

He personifies the post-crisis obsession with monetary morphine, deploying three-and-a-half rounds of bond-buying stimulus during his tenure ("Operation Twist" counts for the half); cutting interest rates to near 0 percent in 2008 and holding them there until he retired; and constantly delaying any threat of an interest rate hike.

Not exactly surprising for a guy dubbed "Helicopter Ben" for his seminal 2002 speech outlying his strategy for defeating Japan's long debt-deflation malaise: Throw freshly printed cash out of a government helicopter.

Now, 14 years on, Bernanke might just put his idea into practice as Japan continues to sink in the quicksand of low growth, deflation and soul-crushing public-sector indebtedness. Like a messianic figure, the prodigal son of money printing has returned.

Related: S&P 500 Hits Record High

Japan is reportedly considering an aggressive $100 billion "helicopter money" stimulus package that would combine new deficit spending with monetization of the debt by the Bank of Japan. Guess who traveled to Japan, ostensibly to discuss and support the next stage in this era of extreme monetary policy? None other than Bernanke-san, who visited the Bank of Japan on Monday morning and lunched with BoJ Governor Haruhiko Kuroda.

These efforts have been boosted by the victory of Prime Minister Shinzo Abe's party in Japan's latest election, increasing his political capital for more proactive efforts to reinvigorate growth.

Abe said he wants to utilize negative government borrowing rates to facilitate investments in modern infrastructure, including high-speed train lines. Further detail is expected at a cabinet meeting on Tuesday. Bernanke is expected to meet with Abe later in the week. The BoJ will hold its next policy meeting on July 28 and 29.

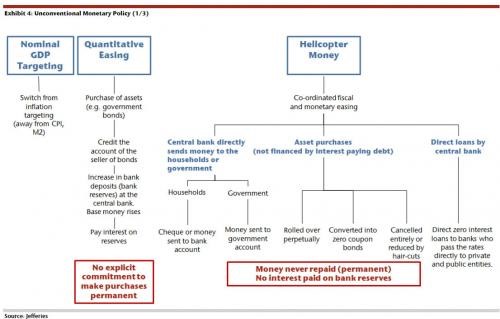

How is this helicopter money? According to investment bank Jefferies, the different between this and regular quantitative easing or asset-purchase stimulus is "a combination of extreme monetary easing and fiscal relaxation."

Jefferies’ Global Head of Equity Strategy Sean Darby believes that the ultimate end game would be a conversion of the BoJ's negative-rate bond holdings into perpetual zero coupon bonds. This would effectively turn the bonds into worthless pieces of paper. And it would ease the government's debt-to-GDP ratio and clear the way for tax cuts and spending hikes.

Bernanke outlined his thinking on this strategy in a blog post for the Brookings Institution back in April. In it, slightly embarrassed by his “Helicopter Ben” moniker, Bernanke dubbed this idea Money-Financed Fiscal Program, or "MFFP" for the economic acronym junkies.

Related: Why Clinton or Trump Could Face a Stock Market Nightmare

With the Bank of Japan already exhausting all other measures — and with Japanese stocks selling off after policy rates were cut into negative territory earlier this year — watch for the debut of MFFP in the weeks to come.

The risk is that this will be seen as another overt attempt to devalue the yen to boost exports, something that will attract the ire of China and could potentially destabilize the energy markets.

The gains in U.S. equities on Monday were technical in nature, driven by a 4 percent surge in the yen carry cross (yen vs. dollar), the largest such surge since February. Japan's Nikkei Average got a nice lift as it was dangerously languishing near its February/June low.

For now, despite the U.S. large-cap breakout, risk remains extremely high. Stocks are notching new highs on valuation expansion alone as earnings continue to crumble and are unlikely to return to growth until 2017 at the earliest. And while the BoJ is stimulative, the Federal Reserve continues to have two quarter-point rate hikes penciled in for 2016.

We also have unresolved political issues surrounding Brexit (with a new British Prime Minister taking office), the U.S. presidential election and simmering tensions in Europe over a possible Italian bank bailout. Breadth remains narrow, with only around 60 percent of stocks in uptrends. Safe havens continue to be well bid. And most stocks, as represented by the NYSE Composite Index, remain around 5 percent below their record highs.

Keep an eye on crude oil. The black stuff has rolled down out of its recent consolidation range to return to early May levels, hurt by production and inventory concerns. Japan's stimulus efforts could further weaken energy prices by bolstering the dollar. Stocks will respond negatively to any renewed energy price weakness.