Stocks wrapped up an abysmal third quarter this week: The Dow Jones Industrial Average lost 7.6 percent — down nearly 1,600 points for the three months — while the Russell 2000 dropped a stomach-churning 12.2 percent. This was the third straight quarterly loss for the Dow in what is the worst run for large-caps since the financial crisis and the second worst run since 1978.

The catalysts for the decline are familiar. Worries over potential rate hikes from the Federal Reserve, weak economic data globally, submerged commodity prices, pinched corporate profitability and the threat of a slowdown in the pace of debt-funded corporate buybacks.

Related: Worried About a Recession? Here’s When the Next Slump Will Hit

The market is on the verge of something more serious. The NYSE Composite Index is in freefall, testing October 2013 levels this week, a 15 percent drop from its May high. High-yield junk bonds are at two-year lows. According to FactSet, S&P 500 earnings are on track for the first back-to-back decline since 2009.

Any way you slice it, a bear market beckons. And what's needed to stop it now might shock you.

Bulls are once more hanging their hats on the only thing that's mattered over the past six years: the flow of cheap-money stimulus. This time, a series of disappointing economic data from Europe to Japan and China has raised the specter of more aggressive action, including negative policy interest rates. There is even chatter out of the Bank of England about outlawing cash as a way to force credit creation through the economy.

Traders seemed to be spurred on by weaker-than-expected industrial production data out of Japan Wednesday morning, which led J.P. Morgan analysts to raise the prospect of further monetary policy easing from the Bank of Japan at its Oct. 30 meeting. The analysts had previously expected the BoJ to wait until early 2016 before taking additional action.

Related: Why Boehner’s Resignation Might Be Bad for the Market

In Europe, a drop in headline inflation back into negative territory raised the prospect of more easing from the European Central Bank. Analysts at Standard & Poor's believe the ECB will extend its bond-buying program beyond September 2016, likely through the middle of 2018. The overall size of the program is expected to reach 2.4 trillion euros, more than double the original announcement.

Over in China, policymakers lowered the mortgage down payment requirement for first-time homebuyers in some cities while cutting the tax on passenger-vehicle purchases.

The buying continued on Wednesday night. Equity futures soared in response to the Chinese Composite PMI economic activity index dropping to the lowest on record. The Caixin China Manufacturing PMI dropped to its weakest print since March 2009. Job losses accelerated to an 80-month high.

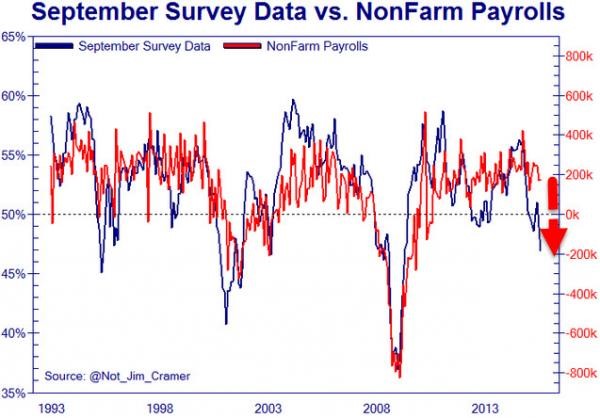

It's an open question whether the U.S. economy can continue to plow ahead in the face of these global headwinds. The chart above suggests that based on the outcomes of the six regional Federal Reserve activity surveys, Friday's non-farm payroll report could be a disappointment.

Early indications suggest America is losing some economic vigor. Evercore ISI's company activity survey has been in a downtrend since the Fed ended its "QE3" bond-buying program at the end of last year. The chart above shows technology sales and trucking company sales have both declined to worrisome levels.

What happens next depends on whether the economy can avoid slipping into recession. If it can’t, the S&P 500 can be expected to decline by 30 percent or more, based on historical averages. If the expansion lives on, the correction might only hit 15 percent, again based on past averages.

In Evercore ISI's estimation, the BoJ might go to negative interest rates in a last ditch effort to avoid slipping into contraction. The European Monetary Union, Denmark, Switzerland and Sweden are already deploying negative interest rates out of policy desperation. Much of the high-rated European bond market is carrying negative yields.

Related: Will Yellen Give in to Wall Street’s Interest Rate Tantrum?

Many Americans subjected to ultra-low-yield bank accounts that charge fees are already experiencing a world of negative effective interest rates. In this world, you pay others for the privilege of holding or borrowing your money. After its September meeting, a policymaker at the Federal Reserve — likely retiring Minneapolis Fed chief Narayana Kocherlakota — indicated a belief that the United States should move to short-term rates below 0 percent, too, and keep rates negative through the end of 2016.

A view through the looking glass comes courtesy of Andy Haldane, the Bank of England's chief economist and one of nine policymakers at the bank. At a recent speech in Northern Ireland, Haldane laid out the case for not only pushing interest rates below zero but also abolishing cash altogether. Bye-bye, dollar bills.

This isn't a new idea, with German Silvio Gesell — a theoretical economist who lived for a time on a vegetarian commune in Argentina — proposing a stamp tax on currency notes over a century ago. And it stems from the risk that when banks start charging people for holding deposits, consumers will horde cash and reduce liquidity throughout the financial system — the exact opposite of what policymakers are seeking.

Haldane's idea? Dumping paper currency for digital, bitcoin-like crypto-currencies. That’s probably not happening anytime soon, but without such a drastic move, stocks could have much more downside to come as traditional monetary stimulus loses its bite.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters. A two-week and four-week free trial offer has been extended to readers of The Fiscal Times.