The Federal Reserve just got back the last $47 billion of the money it had loaned to American International Group in 2008 under an $85 billion line of credit that was part of the desperate effort to keep the world’s largest insurer from going under. The central bank didn’t lose a dime on AIG and has said that nearly all the $3.3 trillion in loans it extended to keep the financial system from imploding has been repaid.

Just a few billion is left on its balance sheet and the Fed expects it all to be paid back. No one got the money for free. The banks, financial institutions and others paid interest rates well above the Fed’s low cost of funds, and with that spread the central bank was able to add $78.4 billion to the Treasury last year.

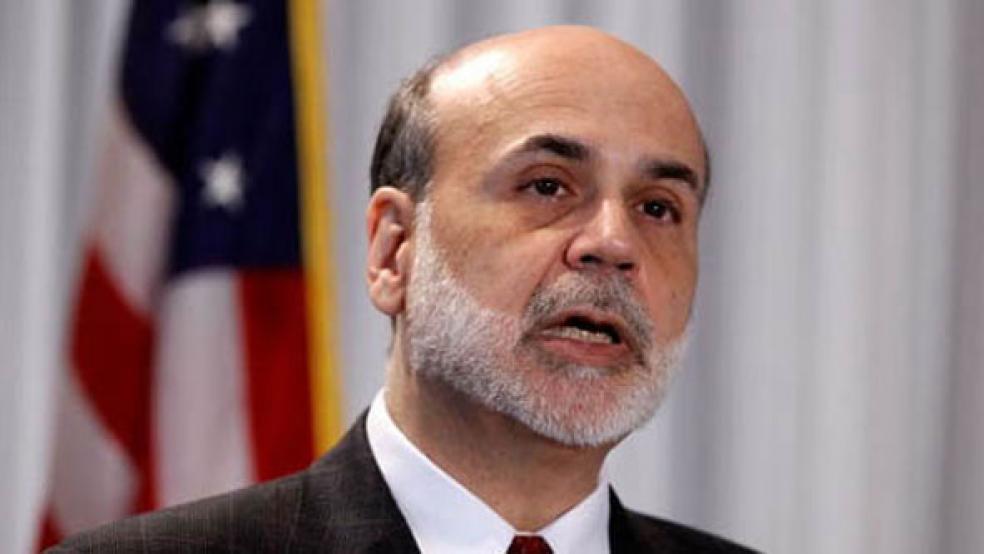

That’s money the Treasury didn’t have to get from investors buying U.S. government debt. “It’s interest the Treasury didn’t have to pay the Chinese,” Fed Chairman Ben S. Bernanke quipped during a congressional hearing this month.

The loans, generally short term and secured, were in addition to the Treasury’s Troubled Asset Relief Program. Big corporations, banks and other financial institutions were among the recipients, including some foreign institutions that otherwise might have had to dump U.S. assets. Had the financial system not stabilized and the U.S. economy not begun to grow again, the outcome could have been very different. That was precisely why the Fed put so much taxpayer money at risk. Despite a flood of complaints from members of Congress and other critics, it paid off for Wall Street, the Treasury and the country.

Some critics disagree. Economist John H. Cochrane, a University of Chicago professor of finance, recently told The New York Times, “From the taxpayers’ view, I think it is a mistake to make much of this number either way.” He added, “The Fed is acting as a huge hedge fund on our behalf. It is borrowing at very low short-term interest rates and investing in long-term government bonds, mortgages and other risky loans. It made a profit on those investments last year, but it is bearing a lot of risk. Inevitably, the day will come when the Fed loses money on these investments, at least on a mark-to-market basis.”

Mark-to-market is an accounting procedure in which assets such as bonds are valued as if they might be sold at any moment. For instance, if market interest rates rise, the value of a bond goes down, and Cochrane is assuming interest rates are going up. But the Fed’s purchases, including the $600 billion of longer-term Treasury securities that is to be completed by the middle of this year, are designed to add liquidity to the bond market and boost the economy, not to make a capital gain.

As the economic recovery continues, at some point the Fed will begin to raise its near-zero target for overnight lending rates, though many economists, including those at Goldman Sachs, say that is much more likely to come in 2012 than this year. Meanwhile, longer-term rates have gone up somewhat, as Bernanke noted last week, because economic prospects have brightened.

When short-term interest rates begin to rise, the cost of funding for the Fed’s $2.4 trillion balance sheet will increase, and the central bank’s payments to the Treasury will go down. But to Fed officials, that will be good news because it will mean the economic expansion is proceeding at a healthier pace.

Can the Fed Lose Money?

Economist Ray Stone of Stone & McCarthy Research Associates some months ago raised the question of whether the Fed’s freedom to raise its overnight rate target might be limited by a need to keep the target below whatever average rate of return it is getting on its assets. In other words, if the Fed were earning, say, 5 percent on its assets, could it have a target rate no higher than that because it would otherwise lose money?

An important related question is this: If the Fed loses money, would it have to seek appropriations from Congress to fund its operations, giving politicians a new lever with which to influence the central bank’s monetary policy decisions?

The answer to both questions, based on the essential nature of a central bank, turns out to be “no.”

If the Fed were like a commercial bank and faced the possibility of losing money on risky assets, it would set aside a portion of its earnings as a reserve to cover the potential loss. The Fed, however, isn’t allowed to retain earnings. After covering its expenses--and paying a fixed 6 percent return on the capital that commercial banks in the Federal Reserve system are required to have invested in it — the Fed must pay whatever is left to the Treasury each year.

Whenever the Fed shows a profit, it goes to the Treasury. If it should sometime in the future show a loss, that’s going to be the Treasury’s too, according to an accounting “clarification” the Fed released this month. No money would change hands. The account from which Treasury normally would be paid would just show a negative balance until later earnings covered the red ink.

In one sense that’s just an accounting sleight-of-hand. But since the Fed can’t retain earnings, it makes sense. Most importantly, it means the Fed is free to pursue policies needed to support the economy and disregard critics such as Cochrane who can’t tell the difference between a central bank and a commercial bank.