Three big numbers last week said a lot about the American economy. The news is better than first appeared.

• Retail sales dropped 1.2 percent in May, but the more important reading on “core” sales edged up 0.1 percent

• The June index of consumer sentiment hit a two-year high of 75.5, and households expressed an improved view of the job markets

• Through the first quarter, households regained $6.3 trillion of the $17.6 trillion in wealth they had lost during the recession

So far, households are confounding the doomsayers. They are making a surprisingly solid contribution to the economic recovery, even as they deal with heavy debt from mortgages and credit cards, the need to save more and restore lost wealth, and a still-weak job market. May brought a new round of anxiety, including a setback for private-sector job growth and plunging stock prices driven by Europe’s sovereign debt crisis, both of which are feeding fears that the recovery could fizzle out.

Those fears were heightened by the government report last Friday showing that retail sales in May dropped by a shocking 1.2 pecent, the largest decline in eight months. Consumers, who buy about 70 percent of everything sold in the U.S., are crucial to a self-sustaining economic recovery. They feed the cycle: As demand picks up, so do production and profits, spurring businesses to expand their facilities and payrolls, which generates more income and demand to keep the upswing going.

On the surface, May’s drop in retail sales is alarming, but it’s important to look at the data the way economists do. The pieces of the retail report included in consumer spending when the Commerce Dept. calculates overall growth in gross domestic product look much more buoyant. For starters, sales at building materials and equipment stores, which fell 9.3 percent in May and accounted for more than half the month’s retail sales decline, go into the housing component of GDP. They’re not considered consumer spending. The plunge most likely reflected last-minute buying before the end of Washington’s “Cash for Appliances” rebate program. Sales in the building supplies category had spiked more than 8 percent in both March and April.

Second, GDP uses unit sales of autos, not the dollar amount in the retail report, which showed a 1.7 percent decline. The actual number of cars and light trucks sold in May increased to an annual rate of 11.6 million, up from 11.2 million in April and above the 11 million average pace in the first quarter. And third, the month’s decline in retail receipts reflected a 3.3 percent falloff in gasoline sales, but that’s not because people were buying less gas. It reflected the recent drop in pump prices, which fell more than 5 percent during May. That’s a plus for consumers.

Excluding these three categories, “core” retail sales actually edged up 0.1 percent in May, including gains in furniture, electronics, food, and Internet sales. The report does little to change analysts’ general belief that inflation-adjusted consumer spending is on track to post about a 3 percent advance in the second quarter, close to the solid 3.5 percent pace recorded in the first quarter. Economists at Barclays Capital say real consumer spending this quarter was tracking slightly below their 3.5 percent estimate prior to the report, while analysts at UBS and JPMorgan Chase offered projections for second quarter consumer spending of 2.9 percent and 2.6 percent, respectively.

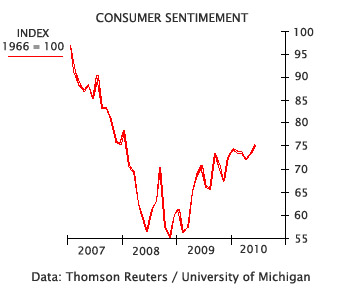

The road ahead won’t be easy, but despite the headwinds, households are clearly casting off some of their extreme caution during the financial crisis. If May’s disappointing news on private-sector jobs and weakness in the stock market weighed on consumer psychology, it didn’t show up in the Thomson Reuters/University of Michigan index of consumer sentiment for June. Contrary to expectations, the index rose to 75.5 early this month, from 73.6 in May and the highest reading since June 2008. This report buoyed stocks Friday, and major indexes finished slightly higher for both the day and the week even after the retail sales report. The June survey shows households remain concerned about their own finances, analysts say, but their view of job market conditions is somewhat better than in previous months.

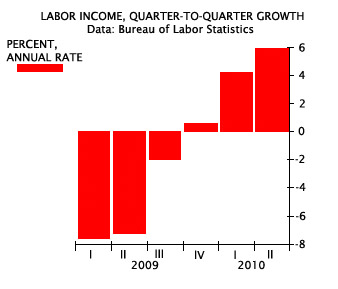

Other recent reports strongly suggest that companies have reached the point where they must ramp up their exceptionally lean payrolls. Labor markets are the linchpin for a sustainable upswing in consumer spending, which is why the stock market plunged on June 4 in reaction to May’s weakness in private-sector payrolls. However, one important trend went largely unnoticed. The length of the workweek continued to rise, signaling that further gains in payrolls are likely. Early in recoveries, more hours of work always precede more hiring. Plus, even with recent modest gains in hourly pay, more jobs and longer hours mean overall income has accelerated sharply, while low inflation boosts the buying power of wages.

In addition, consumers are starting to recover from the economic meltdown that began in 2008, although many stock portfolios have taken a big hit in the last two months. Household net worth—which is the value of assets such as homes and investments minus liabilities like mortgages and other debts—rose 2 percent in the first quarter, according to the Federal Reserve’s latest tally. Consumers have regained $6.3 trillion of the $17.6 trillion in wealth lost during the recession.

Economists at Barclays Capital note that households are now starting to take money out of bank accounts and money market funds, after pouring money in during the recession. At the same time, consumers appear more willing to borrow. In April, the volume of consumer installment debt rose for the second time in four months, after falling since the middle of 2008.

On the credit front, Ben Bernanke & Co. are shaping up to be consumers’ biggest ally. Given the new uncertainties from Europe, nervous financial markets, slow relief from high unemployment, all amid continued declines in inflation, the Fed appears content to keep interest rates low well into 2011. That will not only benefit consumers, it will help offset the coming drag from waning fiscal stimulus—another plus that will help to keep the recovery on track.