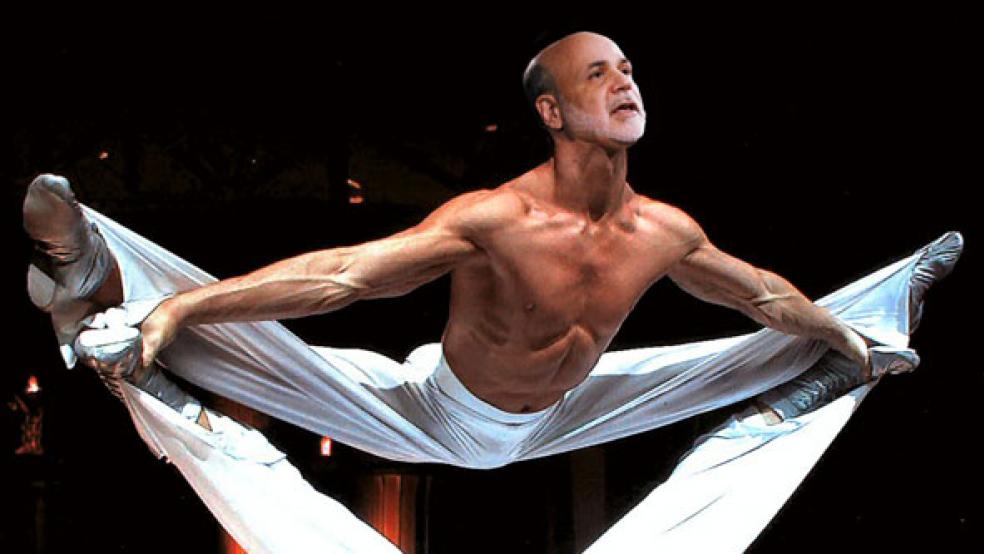

Few would describe Federal Reserve Chairman Ben Bernanke as resembling a yogi.

The former Princeton University economist never ends his remarks with “Namaste,” or strolls through his neighborhood wearing see-through Lululemon pants. But in terms of supporting the economy, flexibility may be the virtue that Bernanke prizes the most.

After the Federal Open Market Committee meeting on Wednesday afternoon, Bernanke said the nation’s central bank would continue to hold its existing pose. It will keep buying $85 billion worth of bonds each month and maintain its key interest rate near zero, in order to make the cost of borrowing cheaper and fuel growth.

The bond purchase program is known as “QE3” – and was outlined by Bernanke yesterday – it is all about flexibility right now.

The name refers to quantitative easing, a fancy term for when a central bank injects money into a lagging economy by buying assets from the private market such as mortgage-backed securities and Treasury’s.

Announced last September without a fixed deadline for being shut down, QE3 is the third distinct attempt at quantitative easing since the 2008 financial crisis.

Should companies go on a hiring spree in the months ahead, Bernanke said the Fed could respond by announcing that it would buy fewer bonds the next month. It would essentially ease up on the pose without having to break it, just in case the hiring was a fluke and the economy then took a turn for the worse.

Here is how Bernanke explained it in econ-speak: “If you see a period in which the labor market is doing better and we have reason to think it might be stronger, then we might reduce accommodation at that point. But it works in both directions. If subsequently the labor market were to weaken and the outlook were to get worse, we could bring back accommodation.”

His idea is that markets could adjust through gradual changes in a way that would be impossible if the Fed abruptly halted QE3. Bernanke didn’t say when the Fed would decide to vary the size of its bond buying. But Michael Feroli, an economist with JPMorgan Chase, ventured in a client note, “Given the Fed’s recent history, we think they will be inclined to vary the pace of purchases at meetings associated with [quarterly] press conferences.”

Economists generally predict that QE3 will taper off by the middle of next year.

In another bit of flexibility, Bernanke said the Fed would continue to assess the health of the economy through a range of factors, including payrolls, filings for unemployment insurance, wages and a host of other factors. So it’s not as though a drop in the 7.7 percent unemployment rate will cause a sudden change by the Fed. Its judgment will be based upon a set of factors that Bernanke did not fully specify, other than to emphasize that the improvements must be sustainable.

“The problem with having just a single criterion is it’s all or nothing,” Bernanke said.

There are risks to this approach. It depends on masterful timing; it could inflate financial bubbles in some assets; and it adds to a Fed balance sheet that now tops $3 trillion. Of the 12 members on the Federal Open Market Committee, Kansas City Fed Bank president Esther George was the lone dissenter on continuing the policy out of concerns it would create financial imbalances and increase inflation over the long term.

But for Bernanke, the potential benefits of whittling down the unemployment rate outweigh the risks. There are good reasons for him to want to stay limber, since the economy either seems to be on the verge of a solid comeback or of being sabotaged by a federal budget fiasco.

This is a sharp contrast from the rigid proclamations coming from Capitol Hill and the White House.

The House Republican majority insists that next year’s budget put the government on the path to a surplus in 10 years exclusively through sharp spending cuts and the repeal of Obamacare programs. President Obama said he will not implement reforms to trim entitlement spending in programs such as Medicare without accompanying tax increases.

The ideological chasm raises the question of whether the two sides can agree on a budget or an increase to the government’s borrowing authority, which is slated to lapse in the middle of May. Without a debt ceiling increase, the government could default and the Fed would be forced into doing damage control.

The Federal Open Market Committee said in a statement Wednesday that the economy had returned to “moderate” growth, but that fiscal policy has become “somewhat more restrictive.” Fed officials released estimates that the economy would grow with a central tendency somewhere between 2.3 percent and 2.8 percent of Gross Domestic Product this year.

The government has shortchanged growth prospects this year through its belt-tightening. The Social Security payroll tax holiday ended this year – reducing most Americans’ paychecks – and the budget sequester went through that will trim federal spending by $85 billion over the rest of this fiscal year.

But despite this threat and the fact that millions of Americans are still without jobs, the stock market applauded the Fed announcement, with the Standard & Poor’s 500 index jumping upward as Bernanke spoke Wednesday afternoon to close at 1,558.71, a 0.67 percent increase. As pointed out by economists at PNC Bank, that is just five points shy of its 2007 record high.