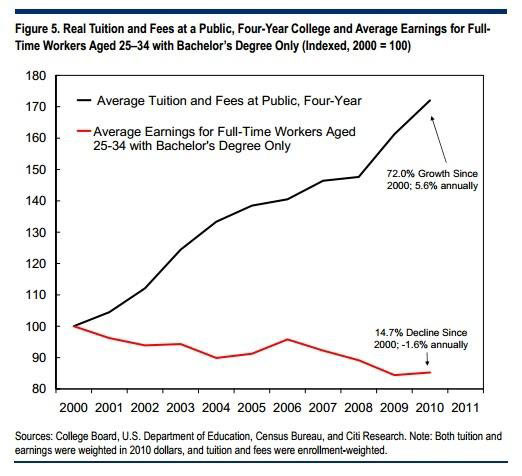

Student debt levels have reached a new high – rising $42 billion in the last quarter to $956 billion, according to a report this week from the New York Fed. At the same time, tuition rates have seen a staggering 72 percent increase since 2000.

As if those two upward trends weren’t hitting students hard enough – the average earnings for full-time workers ages 25-34 with Bachelor’s degrees has also dropped 14.7 percent since 2000. The chart below from Citi shows the striking contrast:

The diverging trends are taking a toll on students and recent grads. Student loan delinquency rates now exceed those of credit card, mortgage, and all other types of consumer debt. And many indebted grads are being forced to delay buying homes, having children and saving for retirement.

While President Obama has supported increasing the availability of student loans, others are questioning if student loans are becoming too easy to obtain, putting those who have no hope of paying off the loan into crushing life-long debt.

Most student loans – 93 percent last year – are currently made by the government, and Stafford loans (which account for more than three-fourths of federal loans), impose no credit standards. Over 20 percent of Stafford loans go to undergraduates enrolling in for-profit colleges, which have default rates that are nearly twice as high as other institutions.

The situation is causing many experts to warn of a student loan bubble that could burst much like the housing market did in 2008. Howard Dvorkin, author of Credit Hell, told The Fiscal Times last month: “It's hard to predict when the student loan meltdown could occur, but if the bubble explodes, the consequences will be devastating for the economy.”