Is the Federal Reserve out of control? The Tea Party thinks so. Suspicion of our nation’s central bank is a recurring theme of the populist movement, which blames the Fed for soaring debt, high unemployment, and a sinking dollar. It also accuses the Fed of being the handmaiden of the Obama administration, and way too cozy with Wall Street. Controversy over the Fed’s most recent quantitative easing program has added fuel to the fire. Given its pivotal role today in the management of our economy, antagonism towards the Federal Reserve might have consequences — for its efforts to boost demand, for the Fed’s long-term independence, and certainly for President Obama.

The Fed’s vulnerability was on display in India this week. In one of the odder diplomatic exchanges in recent times, President Obama promised to support India’s quest to join the UN Security Council, while Prime Minister Singh endorsed the Fed’s quantitative easing. Not as juicy as trade deals, but doubtless welcome to our beleaguered president. China, Russia, Brazil and Germany, concerned that the move may spark competitive devaluations around the globe, have not been so kind.

The Federal Reserve is sailing through choppy seas, giving its most extreme opponents a rare platform. Congressman Ron Paul, for instance, has long called for the Fed’s abolition – a position that must seem to most Americans like campaigning against air. It’s everywhere, it serves a purpose, and after all, what are the alternatives?

That complacency seems to be changing; the Fed’s complete failure to anticipate, much less prevent, the financial crisis has soured the public. In a Gallup poll last year Americans ranked Fed performance dead last in a long list of federal agencies. Tea Party favorite Rand Paul, Ron’s son, just elected to the Senate, promised on his website to “make sure the Fed is held accountable and restore transparency to our monetary system.”

This is no longer a solitary (or strictly inherited) mission. In 2009, a Rasmussen telephone poll recorded that 75 percent of Americans support an audit of the Federal Reserve. HR 1207, a bill requiring an audit of the Fed, garnered 320 supporters in the House but failed to make it into the financial reform bill. It is currently stuck in the House Financial Services Committee.

Tea Partiers are leading this charge. The Manhattan Institute’s Josh Barro, writing for National Review Online, reports those Tea Party organizers took over Maine’s Republican convention in May and adopted a conservative platform that included abolishing the Federal Reserve. The New York Times cited Tea Party candidates Ken Buck in Colorado and Mike Lee in Utah focusing on the Fed, with Lee accusing the Fed of trying to “monetize the debt”.

Ironically, the Tea Party’s growing influence and antipathy come at a time when the Fed has been given even more power by the new Dodd-Frank bill, and has assumed an even more pivotal role in directing the nation’s economy. It is widely acknowledged that the U.S. will have to rely on monetary stimulus to boost growth going forward, since Republican gains in Congress are likely to stymie any further fiscal initiatives.

What exactly does the Tea Party want? David Webb, co-founder of Tea Party 365 and a spokesman for the National Tea Party Federation, says, “We do need to rein in some of the actions of the Fed.” He thinks the Fed is “in collusion with the administration,” and eagerly working to offset the bad policies (such as TARP, which Webb says was mildly productive and the Stimulus, which was not) of the White House. Webb dismisses the “bumper sticker” sloganeering calling for a Fed audit, but does champion a periodic review of Fed operations, and an unbiased inquiry into events of the past few years. He would like, in effect, a 9/11-type commission of uninterested souls to confirm that the Fed is on the up and up.

Others in the group, such as banker Paul Affinita, executive director of Tea Party 365, vehemently oppose the recent easing, which he claims will usher in “hyperinflation” and seriously harm seniors living on fixed incomes. He wants to know what exactly is on the Fed’s books, echoing concerns that the Fed bailed out Wall Street bankers even more than is known.

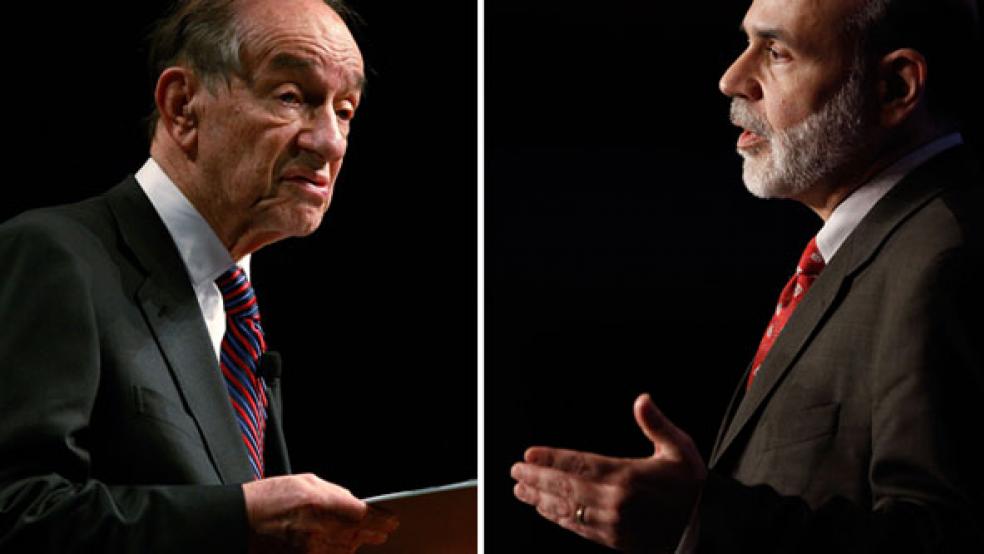

It is not only the Tea Party that is raging against Fed policy. David Stockman, budget director under Ronald Reagan, issued withering criticism recently of the Fed’s approach in an exclusive interview in The Fiscal Times. He said Ben S. Bernanke, the Federal Reserve chairman, is undermining the economy: “I invest in anything that Bernanke can’t destroy, including gold, canned beans, bottled water and flashlight batteries.” Stockman argues that the easing program is absurdly ineffective, and criticizes the inflating of asset prices (such as stocks) in order to rebuild confidence and boost spending. He states, as have others, that QE2 gives all the wrong signals to policymakers, and to businesses.

This tidal wave of antagonism may eventually clip the Fed’s wings. If current policies fail, look for ramped-up efforts to audit the Fed or establish greater oversight. Like a good hanging, higher inflation, a sinking dollar, continued high unemployment and ballooning deficits would easily focus voters’ minds. Not only is Fed independence on the line, so is the election of 2012.