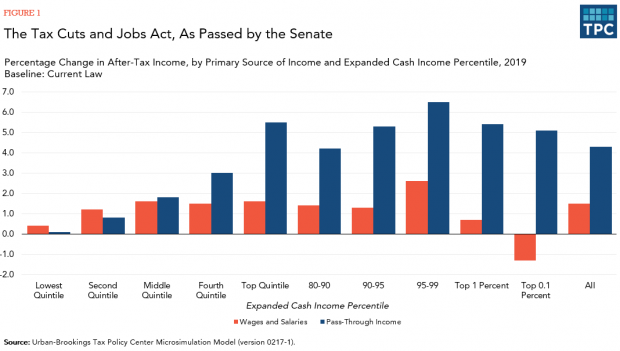

The Republican tax bill rewards some business owners significantly more than their employees, according to a new analysis by the bipartisan Tax Policy Center.

Looking at the Senate version of the Tax Cuts and Jobs Act, TPC found that workers who receive their income as wages would receive a 1.5 percent tax cut on average, while the owners of pass-throughs such as partnerships stand to get a 4.3 percent cut, nearly three times more.

TPC’s Howard Gleckman writes: “To put it another way, Joe the Plumber could get a much bigger tax cut as JTP LLC than as an employee of a building management firm. Similarly, a software engineer may pay less in taxes as a consultant than as an employee — even if she does exactly the same work at exactly the same pay. Or, a partner in a real estate development firm might get a far bigger tax cut than a surgeon employed by a hospital, even though their income is the same.”

Gleckman says that although this is a problem — “This violates a basic rule of good tax policy: that taxpayers with similar situations should be treated similarly” — the conclusion is clear: “on average, taxpayers — especially high-income taxpayers — would be much better off owning their own pass-through businesses than working for someone else.”