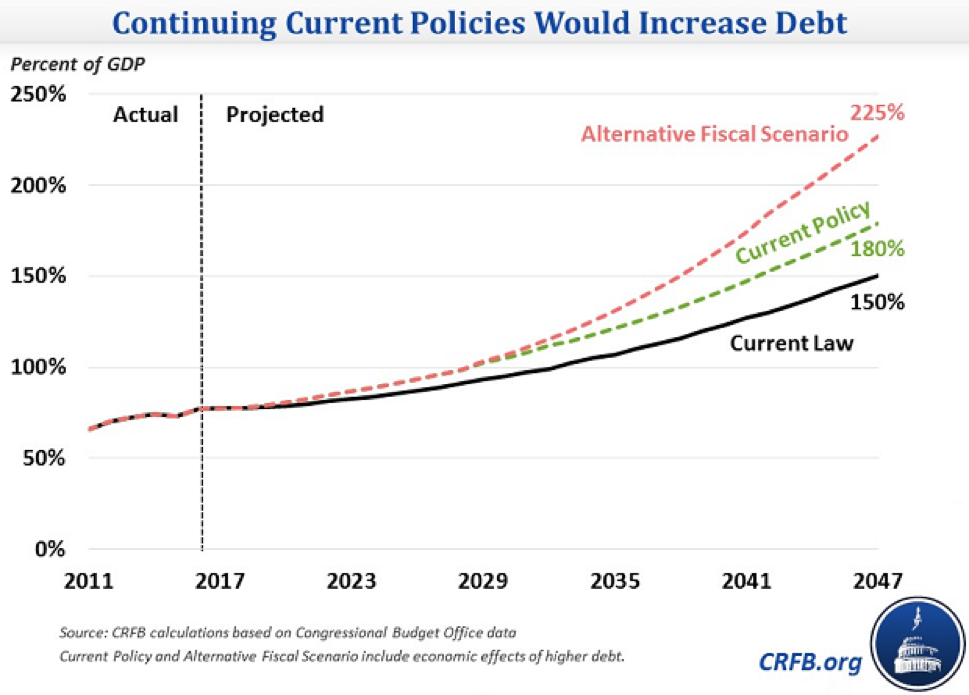

The national debt is on track to reach 150 percent of gross domestic product by 2047, according to the Congressional Budget Office’s 2017 long-term budget outlook. Publicly held debt – the amount the Treasury borrows to keep the government afloat, currently about $14.5 trillion – is already at post-war high of 77 percent of GDP, and the CBO sees it doubling over the next three decades.

The CBO outlook paints a fairly grim picture, but a well-known spending watchdog says the national debt may be in even worse shape. A new analysis by the Committee for a Responsible Federal Budget finds that given the right set of policies and economic circumstances, the debt could actually rise as high as 225 percent of GDP over the next three decades.

Related: A Military Buildup and Big Tax Cuts - Is the Debt Set to Soar Under Trump?

Of course, predicting economic performance and the size of the cumulative public debt over the next 30 years is no easy task. Some might say it’s a fool’s mission.

Even so, at a time when the gross national debt is fast approaching $20 trillion and the Treasury is bumping up against the limits of its borrowing authority, this exercise by the CRFB is worth considering.

The crux of the difference in the forecasts by CBO and CRFB is this: CBO uses a baseline reflecting “current law,” which means that the agency’s numbers crunchers assumes that no new legislation will be passed in the future other than what is needed to keep the government operating at a normal pace. That includes approving budgets, enacting appropriations bills, funding government agencies and programs and financing needed public works projects.

While other legislation will no doubt be proposed and enacted, CBO says it’s impossible to predict what might happen, so they don’t try to anticipate major changes in policy. But the Committee for a Responsible Federal Budget takes a different approach.

Related: How GOP Conservatives Could Make Tax Reform Impossible

Analysts for the anti-deficit research organization go out on a limb in making predictions. They assume, for instance, that a number of temporary tax cuts and business loopholes will be made permanent at some point. Also, they are counting on Congress to permanently repeal three Obamacare taxes currently in abeyance – the medical device tax, the health insurers’ tax and the “Cadillac” tax on high-end health insurance policies offered by employers.

Additionally, the CRFB makes the not unrealistic assumption that Congress will permanently repeal the spending caps on defense and domestic programs mandated by the 2011 Budget Control Act. Those discretionary spending caps have been partially repealed in each of the past four years, but are scheduled to come back in 2018. President Trump has proposed lifting the defense spending cap again next year to make way for a huge military buildup, and there’s a good chance he’ll get his way, especially in the wake of the recent U.S. missile strikes against Syria.

These anticipated policy changes would reduce taxes by $752 billion over the coming decade, boost general spending by $1 trillion and increase interest costs on the debt by $260 billion, according to CFRFB.

“The result would be $2 trillion higher debt, which would bring debt to 96 percent of GDP by 2027 as opposed to 89 percent,” the group’s report states. “By 2047, along with a slight decrease in GDP growth, these policies would bring debt to 180 percent of GDP compared to 150 percent under current law.”

Finally, the CRFP considers an “alternative fiscal scenario” in which revenues are lower after tax cuts and non-health care spending increases to its historical norm of about 10 percent of GDP. Under this scenario, debt would rise to 225 percent of GDP by 2047, nearly three times higher than the current level.