One of the more challenging and frustrating tasks for consumers navigating the health care system is finding physicians and hospitals that are “in network” and willing to accept the coverage terms of their health insurance policies. This is particularly true of patients faced with surgery or other more complicated procedures, when more than one or two physicians are involved.

A new study published this week by the Brookings Institution notes that being diligent about determining that the hospital and doctors performing the procedures participate in their insurance plans may not be enough. People can still be hit with thousands of dollars’ worth of additional “surprise medical bills” – sometimes ten to 20 times what they expected to pay.

Related: Rising Health Care Costs Will Push the Nation’s Debt Into High Risk Territory

“The problem of surprise medical bills for out-of-network care is receiving increasing attention by lawmakers, media, and the public policy community,” the report states. “In various situations—such as emergencies and with consulting specialists—patients are billed by providers that do not participate in their health plan’s contracted network, even though patients did everything they reasonably could to remain in network. As a result, patients incur much higher charges, which sometimes are exorbitant and can lead to financial distress.”

The New York Times in 2014 reported on a classic case of this problem: A 37-year bank technology officer named Peter Drier underwent three-hour neck surgery for herniated disks at the Lenox Hill Hospital in Manhattan. That surgery generated bills of $56,000 from the hospital, $4,300 from the anesthesiologist and $133,000 from his orthopedist (an amount that was subsequently substantially negotiated down. All those charges were covered by Drier’s health insurance policy.

Yet Drier was blindsided when he was charged an additional $117,000 from an “assistant surgeon,” a Queens-based neurosurgeon who Drier didn’t recall meeting, who came in at the last minute to help finish up the surgery. That neurosurgeon was not covered by Drier’s insurance plan and he demanded to be paid in full. “I thought I understood the risks,” Drier told the newspaper. “But this was just so wrong – I had no choice and no negotiating power.”

The same New York Times investigation also uncovered another case in which two plastic surgeons billed a patient an astounding $250,000 for stiches following back surgery. The insurance company was only willing to pay $10,000, which left the patient holding the bag for the balance of the bill.

These surprise and unwelcome charges have grown in recent years as insurers have tightened their standards for medical and prescription drug coverage and have become more selective in designating hospitals and medical providers deemed “in network.” Surprise medical bills arise when patients reasonably assume that physicians, hospitals and out-patient facilities would be in network, obligating their insurers to cover the lion’s share of costs but that are actually out of network.

Moreover, in cases of emergencies – when people’s lives may be on the line and they have no way of determining whether the ambulance they are riding in or the emergency room they are being rushed to are in or out of network – they can be hit with jaw-dropping high medical charges that they must personally cover.

“When situations like these produce surprise medical bills, patients can suffer substantial financial harm,” noted the study, which was prepared by the Schaeffer Initiative at the Brookings Center on Health Policy. “Not only do patients and their health plans lose the advantage of the substantially lower rates typically negotiated with participating providers, out-of-network care is not covered at all by certain types of health plans, such as closed-network HMOs and EPOs,” referring to health maintenance organizations and exclusive provider organizations.

Related: Get Ready for Huge Obamacare Premium Hikes in 2017

While out-of-network care is covered by some so-called open-network plans, patients nonetheless must pay higher deductibles and co-payments for service rendered out of network, especially when the insurers conclude that the charges are not reasonable and customary, the report said.

Health care experts and policy makers have repeatedly warned that the problem of surprise billings is adding many millions of dollars to consumers’ annual medical costs, as they are feeling the brunt of exorbitant out of network fees and charges.

For instance, a 2010 study of larger out-of-network bills submitted under New York state health plans found that, on average, patients saddled with these larger bills were obliged to pay half the total cost of emergency care provided out of network. On average, those charges totaled $3,778 per case. That study also found that charges for out-of-network surgeons averaged $12,120.

When insurance and health care providers disagree on what rates are reasonable, “the financial consequences for patients can be serious, or even ruinous,” the report asserts. This is especially true for the lower-income people who have acquired insurance recently under Obamacare, although these unexpected charges can prove to be a financial burden for middle or upper income people as well.

One national survey conducted this year found that 21 percent of non-Medicare adults have at one time or another received care at a hospital they thought was in-network but were billed by a non-covered physician. Other surveys indicate that roughly five percent of people with private insurance have been stuck with a surprise medical bill within the past year or two.

Related: Rising Health Care Costs Can Eat Up Your Retirement Savings

Republican and Democratic lawmakers in Washington and throughout the country have recognized the growing problem and in some cases have sought to address the problem. More than a dozen states have enacted protections for consumers and state and federal officials are considering additional remedies. “But these efforts are incomplete, and they pursue a variety of different strategies,” according to the Brookings report.

Many of the state measure address unfair surprise medical billings in emergency situations, rather than taking comprehensive action targeting surprise billing in all common hospital scenarios, according to the report. Also, federal action is needed that combats surprise billing of patients covered by self-funded employer plans or authorize the states to do so.

The report also recommends improved transparency and notice to patients about out-of-network situations and charges, while recognizing that “improved transparency and voluntary efforts alone will not eliminate situations of unfair surprise.”

And it calls for enactment of firm measures “that hold patients financially harmless from additional costs associated with non-network bills, while urging hospitals to increase network participation by key physician specialists.

The study was done for Brookings by Mark Hall, Paul Ginsburg, Seven M. Lieberman, Loren Adler, Caitlin Brandt and Margaret Darling.

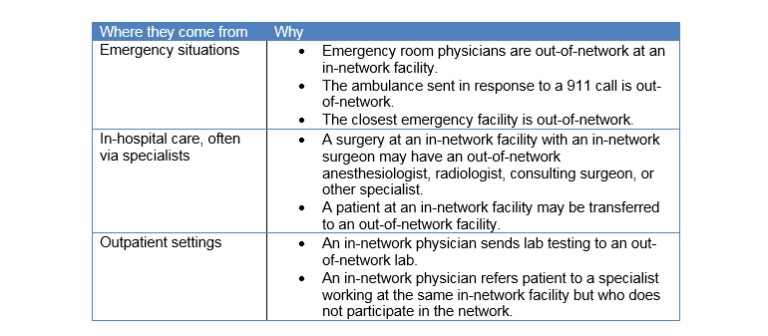

Here are the common origins of surprise medical bills, according to the Brookings report: