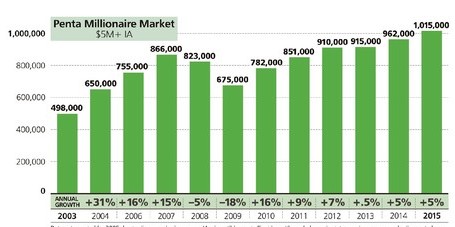

The slow but steady growth of the U.S. economy is richly rewarding wealthy households -- and creating more of them. A new report from Barron’s finds that the number of American households with more than $5 million in investible assets increased 5 percent last year.

The report, written in conjunction with the Boston Consulting Group, finds that more than one million households now have $5 million in assets excluding their homes. That’s the first time the number of so-called “penta-millionaires” has crossed that threshold.

Related: These Big Investors Are Bailing on Hedge Funds

Still, $5 million isn’t what it used to be. Using data from Morgan Stanley Wealth Management, the Barron’s report projects that an individual with a $5 million portfolio in a 60/40 mix of stocks and bonds would generate roughly $138,000 a year after taxes. A sizeable sum, to be sure, but just enough to comfortably rent a three-bedroom apartment in New York City or San Francisco, with little left over.

Source: Barron’s

“In this environment, you’re really not that well-off in terms of annual expectations,’ Lisa Shalett, head of investment and portfolio at Morgan Stanley Wealth Management told Barron’s. “Particularly for those who are retired, if they don’t have a pension or any other income and they are just living off their investment income—you are talking about a more modest life.”

The number of millionaires with $20 million to $100 million in assets was the fastest growing group among the wealthy, increasing 64 percent from 2014 to 2015, according to the report, as many families sold off their businesses or cashed in stock options over the past year.